This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Wednesday, June 15, 2022 Today’s newsletter is by Brian Cheung, an anchor and reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz. Up until last Friday, the Federal Reserve’s game plan for tackling rapid inflation was clear: raise interest rates by half a percent on June 15. In the last few… Source link

Read More »US STOCKS-Wall Street dips with Fed policy announcement on tap

* FedEx jumps after lifting quarterly dividend by more than 50% * Oracle rises as sales, profit top estimates on cloud boom * Continental Resources jumps on buyout proposal from founder (Updates to mid-afternoon, changes byline) By Chuck Mikolajczak NEW YORK, June 14 (Reuters) – The S&P 500 ended lower on Tuesday as the index was unable to bounce from a sharp sell-off in the prior session with a key policy statement from the Federal Reserve on deck that will reveal how aggressive the central… Source link

Read More »US Inflation Quickens to 40-Year High, Pressuring Fed and Biden

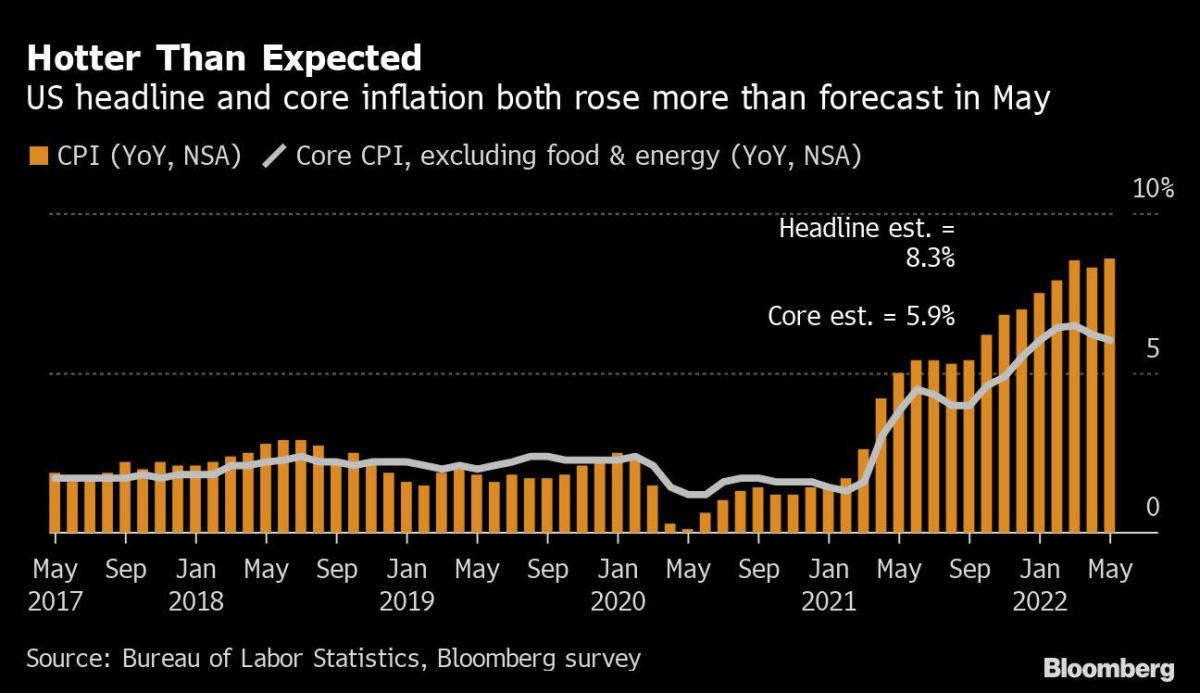

(Bloomberg) — US inflation accelerated to a fresh 40-year high in May, a sign that price pressures are becoming entrenched in the economy. That will likely push the Federal Reserve to extend an aggressive series of interest-rate hikes and adds to political problems for the White House and Democrats. Most Read from Bloomberg The consumer price index increased 8.6% from a year earlier in a broad-based advance, Labor Department data showed Friday. The widely followed inflation gauge rose 1% from… Source link

Read More »Druckenmiller Warns ‘Bear Market Has a Ways to Run’ as Fed Hikes Rates

(Bloomberg) — Stanley Druckenmiller has a warning for Wall Street: The sharp decline in the stock market isn’t over just yet. Most Read from Bloomberg Story continues “My best guess is that we’re six months into a bear market,” Druckenmiller, who runs Duquesne Family Office, said Thursday at the 2022 Sohn Investment Conference. “For those tactically trading, it’s possible the first leg of that has ended. But I think it’s highly, highly probable that the bear market has a ways to… Source link

Read More »A chief investment officer at Ray Dalio’s Bridgewater says stocks will crash another 25% if Fed stays on its current course

If the Federal Reserve stays on its current course of major interest rate hikes, stocks may drop another 25%, according to a top executive at Ray Dalio’s Bridgewater Associates hedge fund. Bridgewater Associates co–chief investment officer Greg Jensen said inflation is not going away, which could force the Fed to continue hiking interest rates, likely more than Wall Street currently anticipates. Story continues “We’re in a radically different world,” Jensen said in an interview with… Source link

Read More »This investing veteran says hot inflation and a tight Fed call for a shift in strategy. He likes 3 specific areas for protection

‘The tide has changed’: This investing veteran says hot inflation and a tight Fed call for a shift in strategy. He likes 3 specific areas for protection 2022 continues to give growth stocks — particularly those in the tech sector — a blunt reality check. The tech-centric Nasdaq index is down 24% year to date, more than double the 10% decline of the Dow over the same period. Story continues MoneyWise recently interviewed investing veteran Claudio Chisani — investment advisor and portfolio… Source link

Read More »Fed Saw Aggressive Hikes Providing Flexibility Later This Year

(Bloomberg) — Federal Reserve officials agreed at their gathering this month that they need to raise interest rates in half-point steps at their next two meetings, continuing an aggressive set of moves that would leave them with flexibility to shift gears later if needed. Most Read from Bloomberg While highlighting the “strong commitment and determination” of all policy makers to restore price stability, the minutes of the May 3-4 meeting, released Wednesday, showed officials attentive to… Source link

Read More »Stock futures drift lower before Fed minutes

U.S. stock futures traded lower Wednesday morning, as investors looked to shake off the latest wave of selling sparked amid growing concerns about the impact of inflation on company profits and the broader economy. Traders also awaited the Federal Reserve’s meeting minutes later in the day, which may help further clarify the path of monetary policy in the near-term. Contracts on the S&P 500 edged lower, steadying after Tuesday’s renewed rout. Dow and Nasdaq futures were each also off slightly… Source link

Read More »U.S. households felt great about their finances as inflation soared last year: Fed

The Federal Reserve reported financial well-being last year reached the highest levels since at least 2013, underscoring the impact of economic stimulus that also led, in part, to high inflation. About 78% of the roughly 11,000 households surveyed by the Fed reported either “doing okay” financially or “living comfortably,” the highest level seen since the Fed began the survey in 2013. The report noted that household strength was particularly high among parents, due in part to the 2021… Source link

Read More »Why the Fed matters to regular Americans, in one stunning chart: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Friday, May 20, 2022 Today’s newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. For the general public, the Federal Reserve can be an intimidating and arcane subject. Why, you might ask, does it really matter what a few economists in Washington, D.C. think the right level of… Source link

Read More »