(Bloomberg) — Chinese developer shares dropped following local media reports that China Evergrande Group has been ordered to tear down apartment blocks in a development in Hainan province. Evergrande halted trading in its shares. Most Read from Bloomberg An index of Chinese developer shares slumped as much as 2.8% in Hong Kong before closing 1.7% lower. A local government in Hainan told Evergrande to demolish 39 buildings in 10 days because the building permit was illegally obtained, Cailian… Source link

Read More »Evergrande Declared in Default as Huge Restructuring Looms

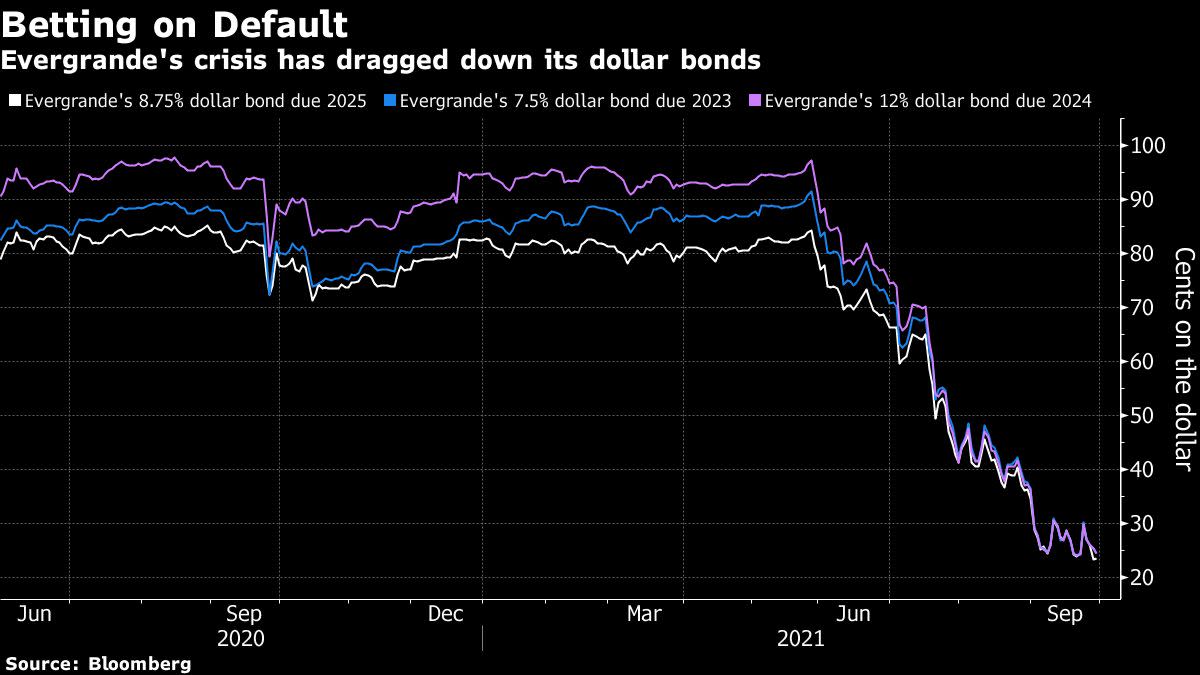

(Bloomberg) — China Evergrande Group has officially been labeled a defaulter for the first time, the latest milestone in months-long financial drama that’s likely to culminate in a massive restructuring of the world’s most indebted developer. Most Read from Bloomberg Fitch Ratings cut Evergrande to “restricted default” over its failure to make two coupon payments by the end of a grace period on Monday, a move that may trigger cross defaults on the developer’s $19.2 billion of dollar… Source link

Read More »China Steps Up Efforts to Ring-Fence Evergrande, Not Save It

(Bloomberg) — As China Evergrande Group edges closer to a massive restructuring, Beijing has stepped up efforts to limit the fallout, signaling it’s willing to prop up healthy developers, homeowners and the real estate market at the expense of global bondholders. In the last week alone, Chinese authorities have dispatched top financial regulators to nudge the country’s massive banks to ease credit for homebuyers and support the property sector. They also bought out part of… Source link

Read More »European Futures Rise; Evergrande Hits Asia Stocks: Markets Wrap

(Bloomberg) — Asian stocks and U.S. equity futures started the week on the back foot, as investors weighed the prospects for growth against concern over inflationary pressures. Most Read from Bloomberg Japanese and Hong Kong shares dropped. Earlier gains vanished after trading of China Evergrande Group shares was suspended in Hong Kong, along with those of its property management unit. Mainland Chinese markets are closed through Thursday for the Golden Week holidays. Australian shares bucked… Source link

Read More »China Evergrande to raise $5 billion from property unit sale

By Tom Westbrook and Donny Kwok HONG KONG (Reuters) -Distressed developer China Evergrande will sell a half-stake in its property management unit to Hopson Development for more than $5 billion, Chinese media said on Monday, after both Evergrande and Hopson requested trading halts ahead of a major transaction. Once China’s top-selling developer, Evergrande is facing what could be one of the country’s largest-ever restructurings as a crackdown on debt leaves it unable to refinance $305 billion… Source link

Read More »China’s Power Crunch Is Next Economic Shock Beyond Evergrande

(Bloomberg) — China may be diving head first into a power supply shock that could hit Asia’s largest economy hard just as the Evergrande crisis sends shockwaves through its financial system. Most Read from Bloomberg The crackdown on power consumption is being driven by rising demand for electricity and surging coal and gas prices as well as strict targets from Beijing to cut emissions. It’s coming first to the country’s mammoth manufacturing industries: from aluminum smelters to… Source link

Read More »The Evergrande ‘Lehman moment’ analogy is wrong

China’s Evergrande saga is troubling, and it could definitely signal coming ruptures in China’s real estate and financial markets. But suggesting it’s a “Lehman moment” gets the magnitude wrong and distorts some important lessons form the financial crash of 2008. If anything, the giant property developer poised to default on billions in debt is a “Bear Stearns moment,” a distinction that clarifies what might be similar to the 2008 crash, and what might be different. Here’s a… Source link

Read More »The hidden meaning behind the Evergrande blow up: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Wednesday, September 22, 2021 Debt, debt everywhere — and not a drop of it paid for Have you heard? The United States is on the path to a showdown over the debt ceiling — again. As the spectacle of heavily-indebted Chinese real estate giant Evergrande held investors in its sway for a second day, another drama slowly played itself out on the… Source link

Read More »European stock markets push higher as Evergrande fears ease

The real estate company said a payment due on Thursday, for an onshore renminbi-denominated bond, had ‘already been resolved through off-exchange negotiations’. Photo: Hector Retamal/AFP via Getty Images European stock markets were sharply higher on Wednesday as worries over the Evergrande crisis in China started to ease. The real estate company said a payment due on Thursday, for an onshore renminbi-denominated bond, had “already been resolved through off-exchange negotiations”. Traders… Source link

Read More »China’s Evergrande is probably ‘too big to fail’: Market strategist

The thought of a Lehman Brothers-esque collapse in China sent U.S. investors running for the exits Monday. The Dow Jones Industrial Average (^DJI) sank 614 points, while the S&P 500 (^GSPC) fell 75 points and the Nasdaq Composite (^IXIC) plunged 330 points. It was the market’s worst one-day slide in months and shattered an extended stretch of calm for stocks. The S&P 500 hadn’t fallen more than 1% since mid-August. Investors were rattled by news that the major Chinese real estate developer… Source link

Read More »