‘Investors are now nervously eyeing October, and wondering perhaps if this could be the beginning of further weakness.’ Photo: Daniel Roland/AFP via Getty Images There was blood in the markets on Friday, as European stocks dragged lower after posting their first negative month since January. It came as Eurozone inflation hit its highest level in 13 years due to surging energy prices. According to Eurostat, headline inflation came in at 3.4% last month, the highest level since September 2008… Source link

Read More »European stock markets push higher as Evergrande fears ease

The real estate company said a payment due on Thursday, for an onshore renminbi-denominated bond, had ‘already been resolved through off-exchange negotiations’. Photo: Hector Retamal/AFP via Getty Images European stock markets were sharply higher on Wednesday as worries over the Evergrande crisis in China started to ease. The real estate company said a payment due on Thursday, for an onshore renminbi-denominated bond, had “already been resolved through off-exchange negotiations”. Traders… Source link

Read More »European Stocks Slide to Two-Month Low on China and Fed Concerns

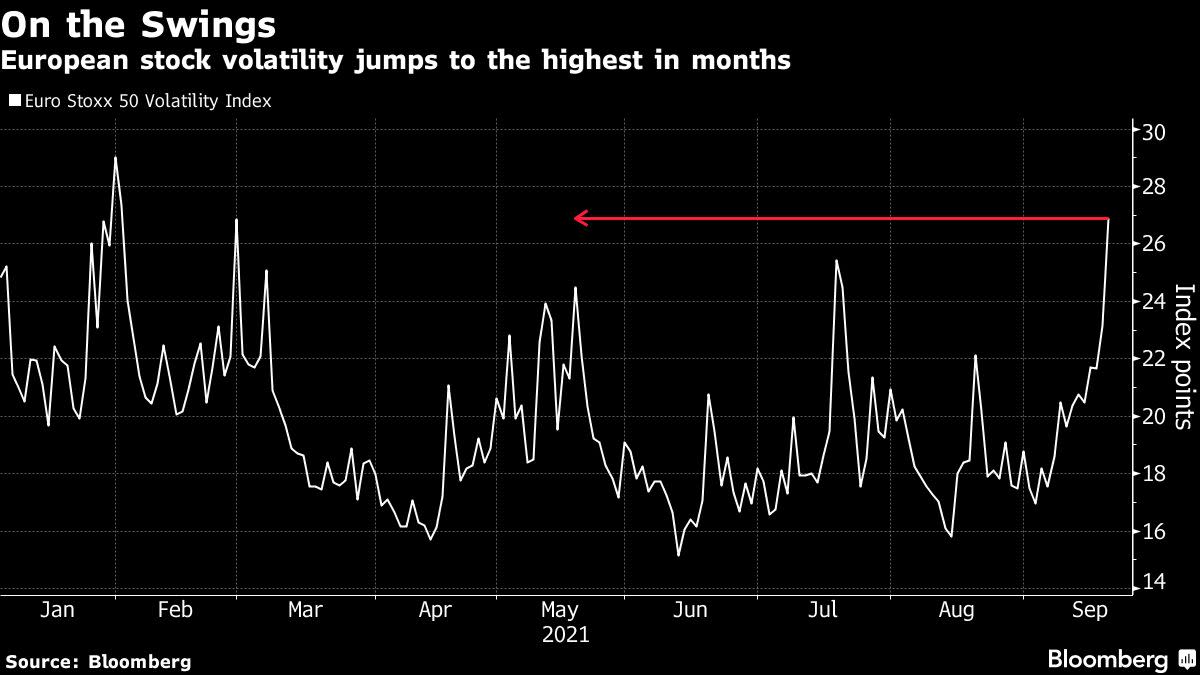

(Bloomberg) — European stocks slid to the lowest level in two months as China’s real estate crackdown and worries ahead of this week’s Federal Reserve fueled risk-off sentiment. The Stoxx Europe 600 index fell 2%, the most in a month and to the lowest level since July 21. Germany’s DAX slumped 2.3% on the day the index’s expansion takes effect, with banks and automotive shares underperforming. While all sectors retreated on the European gauge, miners declined the most, sliding to the… Source link

Read More »European markets weighed down as investors brace for ECB tapering

Markets made muted moves on Thursday morning in London. Photo: Getty European markets saw a muted open on Thursday morning in London, with the FTSE 100 pulling back slightly at the opening bell. Markets are being weighed by talk of the European Central Bank withdrawing its monetary stimulus due to rising inflation. BHP Group (BHP.L) was among the top fallers in the FTSE, falling 4.8% in early trade as it was outbid for a nickel miner active in Canada’s highly-prospective Ring of Fire region… Source link

Read More »Tesla’s Musk says must keep to schedule on European gigafactory

BERLIN (Reuters) -Tesla CEO Elon Musk has made clear how important it is for the company to keep to its schedule for the construction of its European gigafactory in the German state of Brandenburg, its Economy Minister Joerg Steinbach said. Tesla also said it was willing to intensify communication in the site near the town of Gruenheide and involve local citizens more, Steinbach told Reuters after a meeting with Musk in Germany on Wednesday. Tesla has pushed back the expected opening of its… Source link

Read More »European stock markets nosedive amid fears of rising inflation

A string of corporate news also moved individual stocks in London. Photo: Dominic Lipinski/PA Images via Getty Images Stocks in Europe slumped into the red on Thursday as concerns around rising inflation resurfaced after signals from the US Federal Reserve. In London, the FTSE 100 (^FTSE) nosedived 1.9%, hovering just above the 7,000 point mark, while the CAC (^FCHI) was 2.2% down in France, and the DAX (^GDAXI) fell 1.6 % in Germany. “The FTSE 100 fell with miners and banks the principal… Source link

Read More »Google shares its $2M Black Founders Fund among 30 European startups – TechCrunch

Google has selected 30 startups to receive a share of its $2M Black Founders Fund in Europe, providing these companies with a spot of cash, some valuable cloud services, and a bit of good old-fashioned networking among the Google crew. The fund was announced last fall as part of a company-wide effort towards “building a more equitable future for everyone,” alongside grants and new sponsorships. Over 800 companies applied and Google interviewed 100 of them, ultimately winnowing that… Source link

Read More »Today in European Tech: Northvolt is reportedly raising €2.2 billion, Doktor.se scores €50 million, Yandex buys KupiVIP, and more

Hello! Here’s what happened today in European Tech. Deals – Israeli ad-tech company Tremor has filed for an IPO on Nasdaq, after its share price has risen by almost 500% on the London Stock Exchange over the past year to a market cap of about £1.1 billion. – Planet, a Galway-based fintech company, has secured investment from Advent International, a private equity firm. Existing shareholder Eurazeo has sold a portion of its stake to Advent. The deal, according to Eurazeo,

Read More »Google’s European headaches – Fortune

<!– (function(w, l){ w[l]=w[l]||[]; w[l].push({ ‘gtm.start’: new Date().getTime(), … Source link

Read More »Russian internet giant Yandex mulls expanding food delivery service to TWO European capitals as Covid-19 pandemic boosts demand — RT Business News

Russian internet giant Yandex says it will start delivering groceries across Paris and London by the end of the year, after the service gained massive popularity in Russia during lockdowns imposed due to the Covid-19 pandemic. The grocery delivery in the French and British capitals will be run by Yango, an international arm of Yandex Go, which is in cha rge of the company’s taxi aggregator and food tech business. Last year, the subsidiary launched the grocery service in… Source link

Read More »