[unable to retrieve full-text content]Hong Kong Vies With US in Bitcoin ETF Market After Crypto’s Revival Yahoo Finance Source link

Read More »Bitcoin Sinks on Ebbing Fed Rate-Cut Bets and Cooling ETF Demand – Yahoo Finance

[unable to retrieve full-text content]Bitcoin Sinks on Ebbing Fed Rate-Cut Bets and Cooling ETF Demand Yahoo Finance Source link

Read More »BlackRock’s Bitcoin ETF Draws Record Influx as Coin Tops $69,000

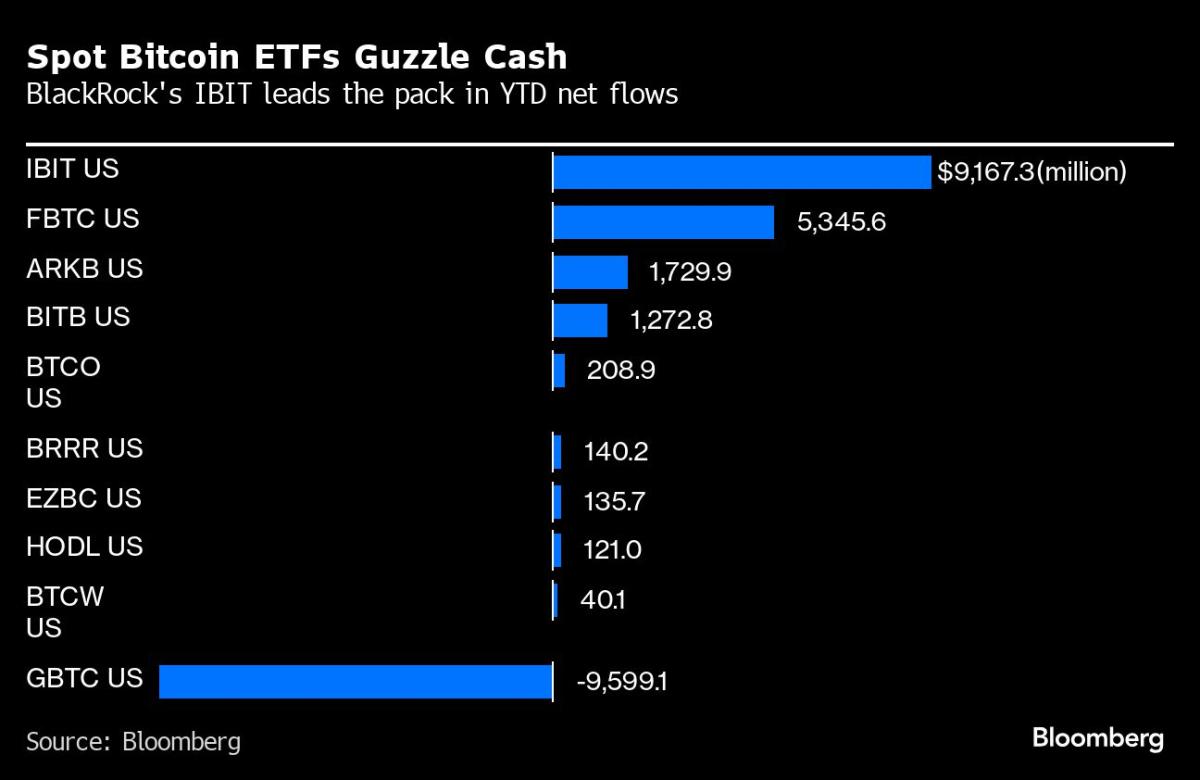

(Bloomberg) — Investors dumped a record amount of cash into BlackRock’s Bitcoin ETF while the cryptocurrency surged to an all-time high. Most Read from Bloomberg The iShares Bitcoin ETF (ticker IBIT) pulled $788.3 million Tuesday, its 37th consecutive inflow. The fund has now swelled to $11.5 billion in assets. Bitcoin briefly topped $69,000 on Tuesday, surpassing the all-time high it hit in late 2021. Demand from the ETFs and a optimism surrounding an upcoming reduction in the token’s… Source link

Read More »Coinbase rides bitcoin ETF frenzy to first quarterly profit in 2 years

Coinbase Global (COIN) posted its first quarterly profit in two years as trading surged on a new wave of optimism about digital assets, marking a potential turning point for the largest US cryptocurrency exchange. Investors cheered the news, sending the stock of Coinbase up more than 12% in after-hours trading. The stock is down 5% so far in 2024 as of Thursday’s close but has soared 180% over the last year. Coinbase earned $273 million in profits during the fourth quarter, well above analyst… Source link

Read More »1 Top Bitcoin ETF to Buy Before the Crypto Market Soars 300%, According to a Wall Street Analyst

The cryptocurrency market is currently worth $1.6 trillion, and Bitcoin (CRYPTO: BTC) accounts for 50% of that total. Bitcoin dominance (i.e., the market value attributable to Bitcoin) was also 50% five years ago, though it has ranged from 38% to 70% during that time period. With that in mind, Morningstar analyst Michael Miller expects the cryptocurrency market to soar 300% to $6.4 trillion by 2032. If Bitcoin dominance stays at 50%, the implied upside for Bitcoin would also be 300%…. Source link

Read More »Franklin Templeton cuts fee on spot bitcoin ETF

Spot bitcoin ETF Franklin Templeton Digital Holdings Trust (EZBC) has cut its fee, making it (as of late Friday morning) the lowest among all current issuers. The asset management firm will also waive fees until the fund reaches $10 billion in assets under management. The newly approved spot bitcoin ETFs collectively saw more than $4 billion in volume on the first day of trading. Sandy Kaul, Franklin Templeton’s Head of Digital Asset and Investor Advisory Services, joins Yahoo Finance Live to… Source link

Read More »SEC says ‘unauthorized’ message about bitcoin ETF approvals not accurate

It was the moment that the crypto world had been waiting for. Then it wasn’t. The price of bitcoin (BTC-USD) soared to nearly $48,000 Tuesday afternoon after the Securities and Exchange Commission appeared to announce on X, formerly Twitter, that the regulator had granted approval for the launch of spot bitcoin exchange-traded funds. The SEC had been expected this week to rule on whether as many as 14 different money managers would be allowed to issue the ETFs, which would allow everyday… Source link

Read More »Cathie Wood talks Tesla, Elon Musk, & spot bitcoin ETF approval – Yahoo Finance

[unable to retrieve full-text content]Cathie Wood talks Tesla, Elon Musk, & spot bitcoin ETF approval Yahoo Finance Source link

Read More »Nadig Talks Global ETF Inflow Surge on Yahoo!

VettaFi financial futurist Dave Nadig appeared on Yahoo! Finance to discuss the recent ETF inflow surge. Global ETF inflows in October surpassed $111 billion, triple what they did in September. “If you look at where that money is actually going, a big chunk of it went to U.S. equities. Over $50 billion flowed in,” Nadig said, noting that where it went inside that was more complicated. “We’re not seeing a ton of money flow into the riskiest of risky ETFs, but we are… Source link

Read More »BlackRock profit beats as ETF demand holds up against market rout

(Reuters) -BlackRock Inc posted a smaller-than-expected drop in quarterly profit on Thursday as strong demand for exchange-traded funds and other low-risk products cushioned the hit to fee income from a global market rout. The threat of a recession, rapidly rising interest rates and the Ukraine crisis have slammed both bonds and stocks this year, keeping investors on the back foot in a blow to businesses such as BlackRock. The company’s assets under management (AUM) dropped 16% year-on-year to… Source link

Read More »