[unable to retrieve full-text content]Bitcoin holds ground amid Binance lawsuit, XRP continues run up, U.S. equities dip Yahoo Finance Source link

Read More »Bitcoin moves above US$28,000, Ether gains, XRP surges, U.S. equities rally – Yahoo Finance

[unable to retrieve full-text content]Bitcoin moves above US$28,000, Ether gains, XRP surges, U.S. equities rally Yahoo Finance Source link

Read More »Bitcoin, Ether, other crypto gain with equities amid global fund injections to support banks – Yahoo Finance

[unable to retrieve full-text content]Bitcoin, Ether, other crypto gain with equities amid global fund injections to support banks Yahoo Finance Source link

Read More »Bitcoin, Ether, other crypto gain with equities amid global fund injections to support banks – Yahoo Finance

[unable to retrieve full-text content]Bitcoin, Ether, other crypto gain with equities amid global fund injections to support banks Yahoo Finance Source link

Read More »Saudi Arabian Stocks Tumble as Oil, Rates Roil Mideast Equities

(Bloomberg) — Most Read from Bloomberg Saudi Arabian shares closed at the lowest level in about six months, leading declines in Middle East markets, following the global sell-off last week and oil’s plunge on Friday. The Tadawul All Share Index dropped 4.4% at close, with the index posting its longest losing streak since 2020. Aramco fell 4% to the lowest since March 15. Still, the state-controlled oil firm is the world’s biggest listed entity with a market value of $2.17 trillion compared… Source link

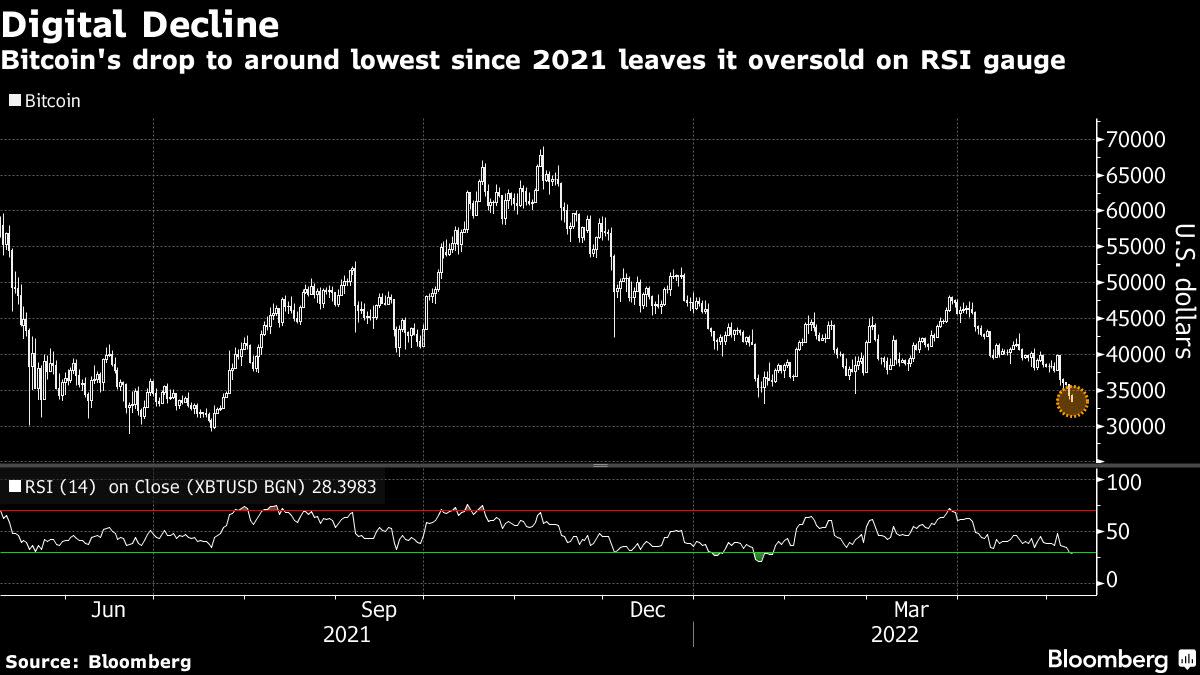

Read More »Bitcoin Flirts With Lowest Level Since 2021 as Equities Drop

(Bloomberg) — Bitcoin is falling toward levels last seen in July 2021, part of a wider retreat in cryptocurrencies amid a global flight from riskier investments. Most Read from Bloomberg The world’s largest digital token dropped as much as 2.7% on Monday and was trading at $33,531 as of 10:28 a.m. in London. The second biggest, Ether, shed as much 4.6%. Most major virtual coins were under pressure over the weekend and the downbeat mood carried over into Monday. Equities in Asia and Europe… Source link

Read More »Stock futures rise as equities look to extend August gains

Stock futures opened higher Tuesday evening, with the major equity indexes holding near all-time highs heading into the first session of September. Contracts on the S&P 500 rose. The index closed out a seventh straight monthly gain in August, rising nearly 3% during the month as strong earnings growth, an ongoing economic recovery and a still-accommodative Federal Reserve helped offset fresh concerns over the Delta variant’s spread. Still, the Nasdaq outperformed with a monthly rise of 4%,… Source link

Read More »U.S. Equities Rise, Yields Steady After CPI: Markets Wrap

(Bloomberg) — U.S. equities rose and government bonds held around the lowest level since March as investors assessed data that showed consumer prices rose more than forecast last month. The S&P 500 was trading around its all-time high as all the main American equity indexes advanced. The tech-heavy Nasdaq 100 was headed toward its highest level since late April as megacap technology stocks rallied. The 10-year Treasury yield eased back below 1.5% following an initial surge in the wake of the… Source link

Read More »European equities muted ahead of UK COVID-19 lockdown easing

TipRanks Billionaire Ray Dalio Places Bet on 3 “Strong Buy” Stocks When billionaire financier Ray Dalio makes a move, Wall Street pays attention. Dalio, who got his start working on the floor of the New York Stock Exchange trading commodity futures, founded the world’s largest hedge fund, Bridgewater Associates, in 1975. With the firm managing about $140 billion in global investments and Dalio’s own net worth coming at $17 billion, he has earned legendary status on Wall Street. Summing… Source link

Read More »Goldman says stay overweight U.S. equities, Bitcoin not an investable asset class in a portfolio

Goldman Sachs’ private wealth management advisers tell the bank’s clients to stay invested primarily in U.S. equities, advice the firm has reiterated annually since the March 2009 market bottom. “We have had a theme of U.S. preeminence and staying invested — these two investment themes — since the trough of the global financial crisis. So as many people have put forth the view that the global financial crisis, for example, dealt a fatal blow to U.S. preeminence, ‘That the 20th century… Source link

Read More »