The Federal Reserve, led by Jerome Powell, raised interest rates earlier this month.Samuel Corum/Getty Images A “stubborn” Federal Reserve has increased the likelihood of a prolonged recession, according to Axonic Capital’s Peter Cecchini. That’s because the Fed could cause economic whiplash that leads it to cutting interest rates sooner than expected. “The 1970’s drawdown scenario of almost 50% for the S&P 500 is becoming all the more likely,” Cecchini said. The Federal Reserve’s decision to… Source link

Read More »Stocks drop after strong jobs data renews rate worries

U.S. stocks slid Friday to close the week lower as investors weighed May jobs data that likely gave Fed policymakers a signal labor market conditions can weather a more aggressive rate hiking cycle. Friday’s sell-off was led by tech stocks, with the Nasdaq Composite falling 2.5%. The S&P 500 fell 1.6%, while the Dow Jones Industrial Average shed 350 points, or 1%. Treasury yields rose following Friday’s jobs data, with the yield on 10-year Treasury jumping as much as 7 basis points to just… Source link

Read More »Treasuries Sell Off, Asia Stocks Drop; Oil Jumps: Markets Wrap

(Bloomberg) — Stocks in Asia fell Tuesday and Treasuries sold off across the curve as investors remain cautious about whether central banks can raise interest rates to rein in inflation without derailing growth. Oil gained after the European Union backed a push to ban some Russian oil. Most Read from Bloomberg Equities in Japan, Korea and Australia inched down while Hong Kong futures fell. US contracts opened higher in the first day of trading after the Memorial Day weekend. Yields on… Source link

Read More »Fertilizer Prices Drop 30% Following Demand Destruction

(Bloomberg) — Fertilizer prices that had hit records are now plunging as buyers reel from sticker shock. Most Read from Bloomberg The June spot price in Tampa, Florida for the nitrogen fertilizer ammonia settled at $1,000 per metric ton, a drop of 30% from May’s $1,425 per metric ton, according to Green Markets, a Bloomberg company. Demand destruction is part of the decline. Places like Southeast Asia are seeing buyers unwilling to pay the record high prices that were posted in April and… Source link

Read More »Stocks Will Be in Bear Market Until a One-Day, 5%-6% Drop, Gartman Says

(Bloomberg) — Dennis Gartman says U.S. stocks are and will be in a bear market until a one-day “violent, downward movement” signals that prices have reached bottom. Most Read from Bloomberg “We’ll have one day when we’ll be down 5% or 6% and that’ll be the final selling pressure,” the chairman of the University of Akron Endowment told Bloomberg Radio on Monday. “That’ll end the bear market.” Investors should “be less involved. Be less long. Try to be as conservative as… Source link

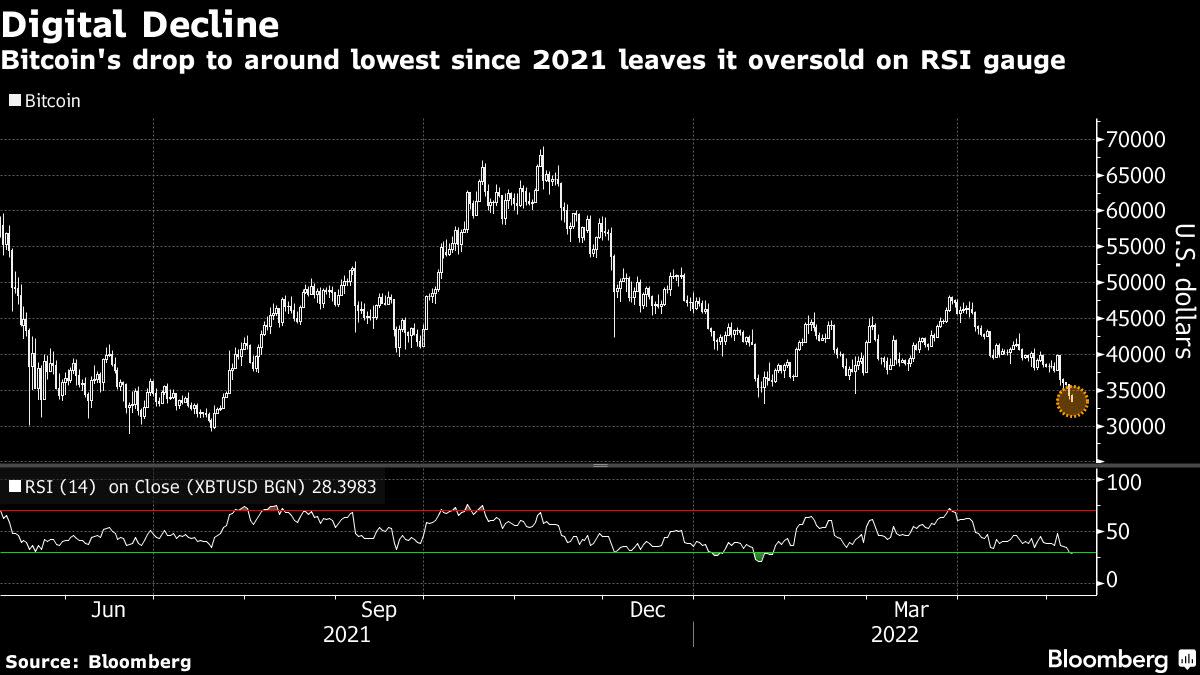

Read More »Bitcoin Flirts With Lowest Level Since 2021 as Equities Drop

(Bloomberg) — Bitcoin is falling toward levels last seen in July 2021, part of a wider retreat in cryptocurrencies amid a global flight from riskier investments. Most Read from Bloomberg The world’s largest digital token dropped as much as 2.7% on Monday and was trading at $33,531 as of 10:28 a.m. in London. The second biggest, Ether, shed as much 4.6%. Most major virtual coins were under pressure over the weekend and the downbeat mood carried over into Monday. Equities in Asia and Europe… Source link

Read More »Apple, Google, Microsoft announce plans to drop passwords

(NewsNation) — Apple, Google and Microsoft announced plans on Thursday to eliminate passwords and replace them with other secure sign-in methods. The announcement came just before World Password Day, which is recognized annually on the first Thursday of May. It highlights the use of safe password habits, but some major tech companies say password-only authentication is of the biggest security problems on the web. “Fundamentally, what we’re doing is letting you use your… Source link

Read More »DiDi Global Sinks on Delisting Plans and Revenue Drop

(Bloomberg) — DiDi Global Inc. tumbled Monday, after the Chinese ride-hailing giant said it’s planning to delist its U.S.-traded shares before it finds a new venue for the stock. Most Read from Bloomberg DiDi’s American depositary receipts sank 18% to $2.01 after it set an extraordinary general meeting for May 23 to vote on delisting its shares from the New York Stock Exchange. While the company will continue to explore listing on another internationally recognized exchange, DiDi said it… Source link

Read More »Players to drop for waiver wire pickups

Many potential fantasy waiver wire gems emerge during the initial weeks of every season. This year, I constantly see recommendations to pick up the likes of Steven Kwan, Tylor Megill, Jesus Luzardo and many other players who started the season on waivers in most leagues before producing inspiring April statistics. Unfortunately, rosters don’t grow in size after Opening Day, and every addition means that someone needs to go. Based on early season numbers, here are some commonly-rostered… Source link

Read More »Stock futures drop, Treasury yields spike as traders await inflation, earnings data

U.S. stock futures pointed to a lower open Monday morning as investors looked ahead to the start of corporate earnings season this week and a bevy of new economic data as the Federal Reserve prepares to accelerate its moves to counter inflation. Contracts on the S&P 500 declined and added to last week’s losses. Nasdaq futures dropped as technology stocks came under renewed pressure. Treasury yields climbed, and the benchmark 10-year yield rose above 2.7% to reach the highest level since… Source link

Read More »