BofA’s US stock chief sees a floor of 3,200 for the S&P 500 (potential downside of 22%) — but here are 4 sectors she likes for inflation protection and cash return We’re almost halfway through the year, and sentiment has yet to turn bullish. The S&P 500 is down 13% in 2022, while the tech-centric Nasdaq is off 22%. If you want to know how low the market could really go, pay attention to what Savita Subramanian — head of U.S. equity and quantitative strategy at Bank of America Securities… Source link

Read More »Should I buy this big dip? Warren Buffett has spent a third of his cash hoard — so it might be a sharp idea to start nibbling

Should I buy this big dip? Warren Buffett has spent a third of his cash hoard — so it might be a sharp idea to start nibbling Warren Buffett is back in his element. After sitting on a growing cash pile for years, Buffett is finally opening up his wallet. The Oracle of Omaha deployed $51 billion in the first three months of this year. That’s roughly one-third of the cash pile his company, Berkshire Hathaway, had at the end of 2021. Here are all the stocks he added to the portfolio in the… Source link

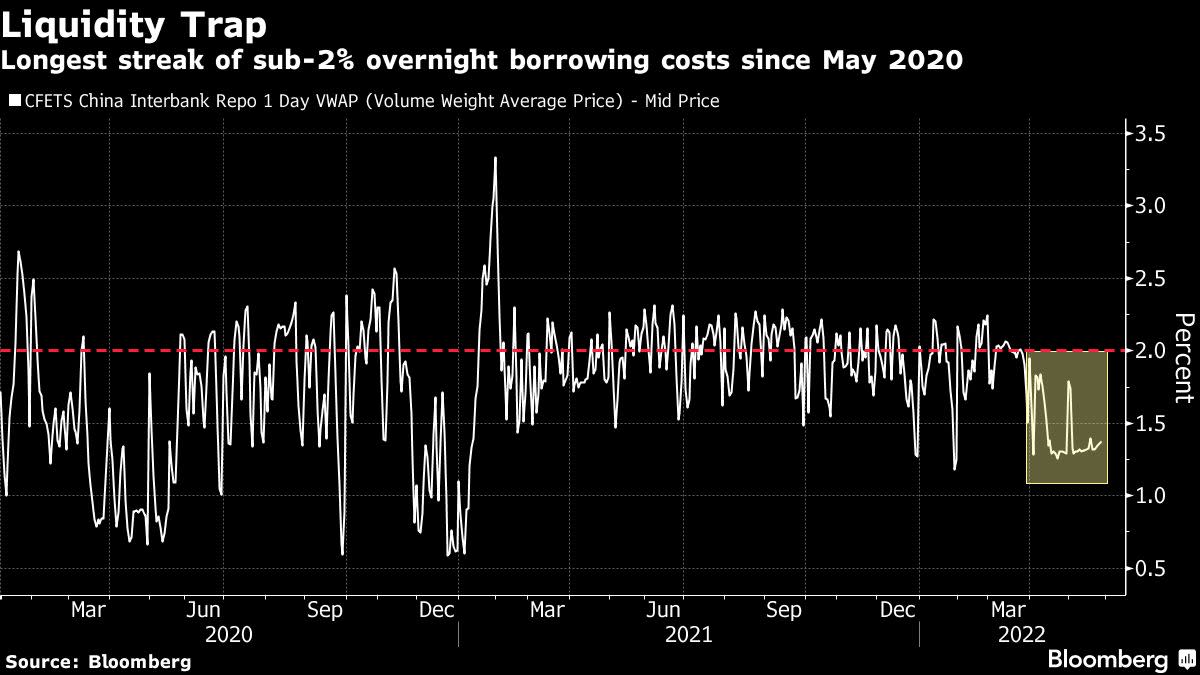

Read More »Chinese Banks Overflow With Cash That Nobody Wants to Borrow

(Bloomberg) — Chinese authorities are facing an uphill battle convincing companies and households to boost borrowing as long as Covid outbreaks and lockdowns continue to crush confidence. Most Read from Bloomberg After loan growth weakened in April to the worst level in almost five years, several indicators suggest the data for May won’t be much better. Housing sales have continued to slump, indicating a lack of appetite for mortgages and subdued credit demand among developers and sectors… Source link

Read More »‘Cash is still trash’ — Billionaire Ray Dalio says keeping money in a savings account is not safe. Here’s what he holds instead

‘Cash is still trash’ — Billionaire Ray Dalio says keeping money in a savings account is not safe. Here’s what he holds instead Some say cash is king. But according to Ray Dalio, founder of the world’s largest hedge fund Bridgewater Associates, it may not be wise to keep too much of your investment money in cash these days. “Cash is not a safe investment, is not a safe place because it will be taxed by inflation,” Dalio told CNBC last year. This week, when CNBC asked him about his… Source link

Read More »Investors are beginning to hoard cash on recession fears: BofA

Investors are starting to get very nervous about the market’s near-term direction, and it shows in their actions. “Russia/Ukraine drives fund manager cash levels to highest since April 2020 (COVID), global growth optimism to lowest since Jul’08 (Lehman),” said Michael Hartnett, Bank of America chief investment strategist, in the latest survey of managers from the bank. The details behind the report are ugly. Hartnett notes growth expectations among fund managers is at a 14-year low. The… Source link

Read More »Google profiting from ‘predatory’ loan adverts promising instant cash | Google

Google is profiting from ads promoting “instant” cash and loans delivered “faster than pizza” despite a pledge to protect users from “deceptive and harmful” financial products. The ads were served to people in the UK who searched terms like “quick money now” and “need money help” and directed users to firms offering high-interest loans. One, listed in Google search results above links to the government website and debt charities, promised “cash in ten minutes… Source link

Read More »Growing and Undervalued – but Amazon.com’s (NASDAQ:AMZN) Cash Flows may Deter Investors

First published on Simply Wall St News Amazon.com, Inc. (NASDAQ:AMZN) is getting stress tested as the stock erases the gains it made in the last 12 months and is currently some 3% in the red. Given that there is a lot of volatility in markets at the moment, we will step back and re-evaluate the fundamentals. For investors, it is important to have a clear picture of the performance of a company, especially during uncertain times. That way, we can be more confident that a stock can regain… Source link

Read More »Warren Buffett has warned against hoarding cash, gold, or bitcoin during wars — and touted stocks as the safest long-term bet

Warren Buffett.Alex Wong/Getty Warren Buffett has advised against swapping stocks for cash, gold, or bitcoin during wars. The Berkshire Hathaway CEO favors productive businesses over dollars, crypto, or haven assets. Buffett touted Russia’s invasion of Ukraine in 2014 as a buying opportunity for long-term investors. Warren Buffett has warned against dumping stocks, hoarding cash, and buying gold or bitcoin when war breaks out, as he believes investing in businesses is the best way to build… Source link

Read More »bne IntelliNews – Russian Yandex to cash on technologies, expand internationally

Russian internet major Yandex is increasingly looking to boost the monetisation of its technologies, on the one hand, and leverage these technologies to support its international expansion, on the other, VTB Capital commented following the publication of 4Q21/2021 results and management update of the company. … Source link

Read More »bne IntelliNews – Russian Yandex to cash on technologies, expand internationally

Russian internet major Yandex is increasingly looking to boost the monetisation of its technologies, on the one hand, and leverage these technologies to support its international expansion, on the other, VTB Capital commented following the publication of 4Q21/2021 results and management update of the company. … Source link

Read More »