JPMorgan says the market bottom is near as corporate buybacks skyrocket — here are 3 high-upside stocks to play that bullish sentiment Stocks have fallen quite a bit in 2022. If you are wondering where the market bottom is, JPMorgan has some good news. The bank sees companies continuing to buy back their shares, which could help stocks establish a bottom. “In the latest sell-off, JPM estimates 3-4x higher buyback executions than trend, which implies the corporate put remains active,”… Source link

Read More »Alibaba Hikes Buybacks to $25 Billion as Crackdown Signals Ease

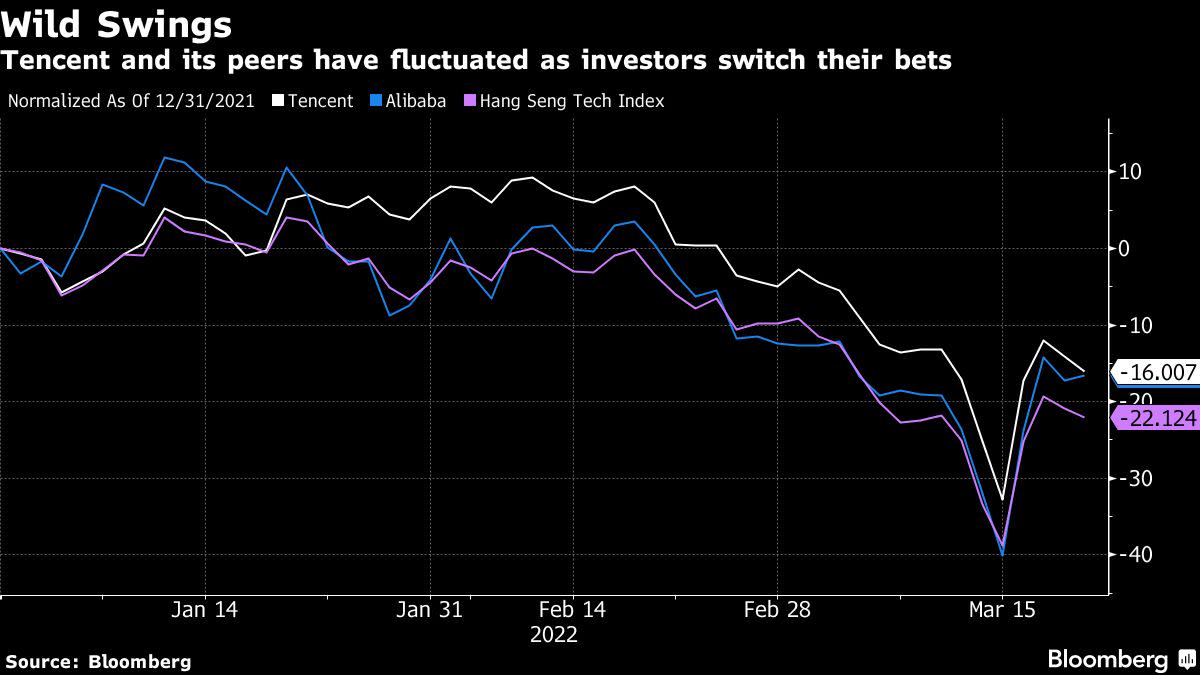

(Bloomberg) — Alibaba Group Holding Ltd. ramped up its share buyback program to $25 billion, expanding that arsenal for a second time in less than a year to stanch a $470 billion loss of value during Beijing’s internet crackdown. Most Read from Bloomberg The board of China’s e-commerce leader has approved the program, which will run for two years through to March 2024, the company said in a statement. It also appointed a new independent director in Shan Weijian, chairman of alternative… Source link

Read More »Buffett Takes ‘Mildly’ Attractive Path With Record Buybacks

(Bloomberg) — Warren Buffett’s Berkshire Hathaway Inc., lacking the blockbuster deals that have galvanized the billionaire investor’s renown, embraced a “mildly attractive” way to deploy its vast cash pile last year via a record-breaking level of buybacks — and showed little sign of changing course. Most Read from Bloomberg Berkshire bought back a total of $27.1 billion in 2021, the highest annual level since Buffett began more aggressively repurchasing stock in 2018. The buybacks… Source link

Read More »Micron kicks off dividend payments, shifts to ‘opportunistic’ share buybacks

By Stephen Nellis (Reuters) – Memory chip maker Micron Technology Inc on Monday said it would shift how it returns cash to shareholders, buying up more shares when prices are low, fewer when prices are high and instituting a dividend for the first time. Micron makes DRAM and NAND memory chips, which are needed for nearly all computing systems and whose price can fluctuate widely based on global supply and demand. This can cause swings in profits – and share prices – at most memory… Source link

Read More »Buffett’s Berkshire Gets More Cautious on Stocks and Buybacks

(Bloomberg) — Warren Buffett’s capital-deployment machine pulled back on several fronts at the start of the year as the billionaire took a more cautious stance on stocks. Berkshire Hathaway Inc.’s net stock sales in the first quarter were the second-highest in almost five years and the conglomerate, where the billionaire is chief executive officer, slowed its buyback pace, according to a regulatory filing Saturday. That helped push Berkshire’s cash pile up 5.2% from three months… Source link

Read More »No such thing as ‘too much:’ Warren Buffett quotes Mae West in defense of stock buybacks

There are many critics of corporate stock buybacks, but Warren Buffett is certainly not one of them. In his latest annual letter to shareholders, the Oracle of Omaha revealed that his holding company, Berkshire Hathaway (BRK-A, BRK-B), had spent nearly $25 billion repurchasing class A shares. Buffett said the action “demonstrated our enthusiasm for Berkshire’s spread” of vast holdings, which include major companies like Apple (AAPL), Bank of America (BAC), Coca-Cola (KO) and Merck ( Source link

Read More »Apple Ramps Up Pace of Bond Sales as Stock Buybacks Seen Rising

(Bloomberg) — Apple Inc. is selling bonds to take advantage of cheap borrowing costs, tapping the market for a third time since May as it looks to return more cash to shareholders. The company is issuing debt in six parts, according to a person with knowledge of the matter. The longest portion of the offering, a 40-year security, may yield between 115 and 120 basis points above Treasuries, said the person, who asked not to be identified as the details are private. Until 2020, Apple hadn’t… Source link

Read More »Fed loosens restrictions on bank share buybacks after second stress test

WASHINGTON, D.C., Dec. 2, 2020 — A man wearing a face mask walks past the U.S. Federal Reserve in Washington, D.C., the United States, on Dec. 2, 2020. Most Federal Reserve districts reported that firms’ outlooks remained positive, but “optimism has waned,” as COVID-19 cases continue to spike, the U.S. Fed said in its latest Beige Book released on Wednesday. (Photo by Liu Jie/Xinhua via Getty) (Xinhua/Liu Jie via Getty Images) The Federal Reserve on Friday loosened its restrictions on share… Source link

Read More »