The housing market has been hot for a couple of years now, and that’s unlikely to change any time soon as millennial demand remains red hot, according to new data from Bank of America (BAC). The 2022 Millennial Home Improvement Survey found that 67% of Generation Y responded that they were likely to buy in the next two years. “The #1 reason cited was an improving financial position, following the trend from the last few years of our survey,” BofA Global Research’s Senior Retail… Source link

Read More »4 ‘buy’ rated stocks for the rest of 2022 with up to 101% upside

Goldman Sachs: 4 ‘buy’ rated stocks for the rest of 2022 with up to 101% upside Year to date, the Dow, the S&P 500 and Nasdaq are all deep in correction territory. But Goldman Sachs still sees plenty of opportunities. In fact, the Wall Street firm has issued ‘buy’ ratings on multiple companies this year, projecting meaningful upside ahead. So here’s a look at four stocks Goldman Sachs is bullish on. These are volatile names, though, so always do your own research before making investment… Source link

Read More »Billionaire Ray Dalio Pulls the Trigger on These 2 ‘Strong Buy’ Stocks

When legends speak, people listen – and few investors match the legendary status of Ray Dalio. The founder of Bridgewater Associates has built his firm from a 2-room apartment operation into the world’s largest hedge fund, with more than $150 billion in assets under management, and a net gain exceeding $46 billion. Dalio believes that the next two to four years will see our global economic and political systems change in ways that are unpredictable now. And the key to survival, for… Source link

Read More »Billionaire George Soros Bets on These 3 ‘Strong Buy’ Stocks

Keeping up the returns would be a neat trick in today’s market, as the main indexes are all steeply down for the year so far – with losses of 15% on the S&P 500 and 24% on the NASDAQ. For investors, then, the best strategy may just be to follow a winner. Billionaire investing legend George Soros is most definitely a winner. He’s built a portfolio worth billions, and had possibly the greatest bull run in hedge fund history, averaging 30% annualized returns for 30 years. Starting in 1992,… Source link

Read More »‘It’s so horrible that I want to buy it’ — Jim Cramer likes these 2 beaten-down tech names that are still posting white-hot revenue growth

‘It’s so horrible that I want to buy it’ — Jim Cramer likes these 2 beaten-down tech names that are still posting white-hot revenue growth The market doesn’t seem able to find a bottom. The S&P 500 has fallen about 16% year to date, while the tech-centric Nasdaq is down 26% over the same time frame. But CNBC’s Jim Cramer sees plenty of opportunity amid the market downturn. In fact, the Mad Money host recently revealed two stocks that he wants to buy right now. Here’s a quick look… Source link

Read More »Time to Bottom Fish? 3 ‘Strong Buy’ Stocks That Are Down Around 50% This Year

What to make of the markets right now? Last week brought more losses in what’s been a volatile year for stocks. The five straight weeks of market declines marked the longest such streak in over a decade. More ominously, they came in along with a number of other disturbing data points. The April jobs numbers, released on Friday, came to 428,000 jobs added for the month, superficially strong and well above the 391,000 expected. But the labor remains depressed, and the total number of workers,… Source link

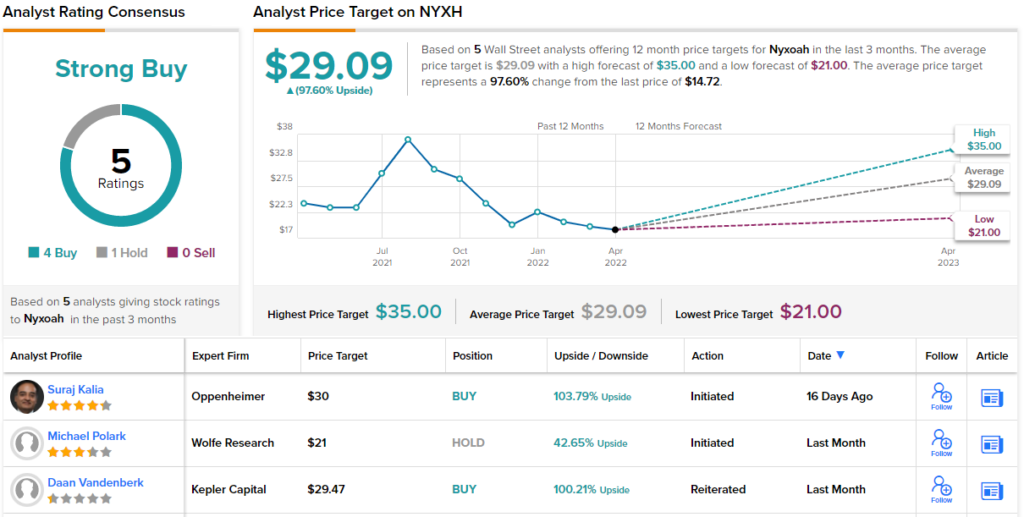

Read More »2 ‘Strong Buy’ Stocks Oppenheimer Sees Surging Over 80%

The markets went into bloodbath mode on Thursday as all the main indexes tumbled by at least 3%, with the NASDAQ’s 5% drop the most acute. That represented the tech-heavy index’s biggest one-day dive since June 2020. The force of the plunge confirms what we all know by now – the market headwinds are piling up, one upon the other. At its base, the issue is simple: there are too many problems, coming in too fast, and both the impersonal markets and the individual investors are finding it… Source link

Read More »Yandex (NASDAQ:YNDX) Receives Average Rating of “Buy” from Brokerages

Shares of Yandex (NASDAQ:YNDX – Get Rating) have been given an average rating of “Hold” by the six brokerages that are currently covering the firm, MarketBeat.com reports. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and three have assigned a buy rating to the company. The average twelve-month target price among analysts that have covered the stock in the last year is $83.40. A number of brokerages have… Source link

Read More »Media mogul Byron Allen says Netflix is a ‘great buy’

Netflix is still reeling from its unexpected decline in Q1 subscribers, which led to a stock plummet of 35% and wiped more than $50 billion off of its market cap. The streaming giant’s disappointing results came as inflation remains high, consumers cut costs and competition intensifies, although one media mogul is not giving up on Netflix quite yet. “I don’t think Netflix has crashed — quite frankly, I think the market has overreacted,” Byron Allen, the founder and CEO of Entertainment… Source link

Read More »Buy These 2 Beaten-Down Stocks Before They Rebound, Says Wells Fargo

As an indication of how the stock market has suffered so far this year, the 2022 selloff has been unlike anything seen for the last 80 years. While there have been a host of reasons for the market wide rout, the meltdown has been most acute amongst growth stocks. As Wells Fargo’s Head of Equity Strategy Christopher Harvey puts it, “the sell-off is all about ‘growth’ — but not economic growth. Rather, it is about the growth style, the mispricing of duration, and risk appetite (or lack… Source link

Read More »