Orion Engineered Carbons S.A. (NYSE:OEC) insiders who purchased shares in the last 12 months were richly rewarded last week. The stock climbed by 6.3% resulting in a US$62m addition to the company’s market value. Put another way, the original US$2.7m acquisition is now worth US$2.9m. While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing. … Source link

Read More »Morgan Stanley Bullish on These 2 Stocks for at Least 40% Upside; Here’s Why

Inflation has been making headlines all year, and rightly so; it’s at 40-year high levels, driven by sharp increases in the prices of gasoline and diesel fuels. But oil and its various refined products have come down in recent weeks, and so – the July inflation numbers weren’t as bad as had been feared. The overall year-over-year price increase for the month came to 8.5%, still awful, but less than the 8.7% economists had been predicting. Markets these days are rallying in… Source link

Read More »10 reasons to be bullish on stocks right now, according to JP Morgan

Inflation remains frustratingly elevated. Recession talk still dominates Wall Street despite a surprisingly strong July jobs report. And second quarter earnings season has been anything but great. But all that’s not stopping top JP Morgan strategist Mislav Matejka from being bullish on stocks. “We believe that risk reward for equities is not all bad as we move into year-end,” Matejka said in a new note to clients on Monday. “In fact, we argued that we have entered the phase where the weak… Source link

Read More »JPMorgan says the market bottom is near as corporate buybacks skyrocket — here are 3 high-upside stocks to play that bullish sentiment

JPMorgan says the market bottom is near as corporate buybacks skyrocket — here are 3 high-upside stocks to play that bullish sentiment Stocks have fallen quite a bit in 2022. If you are wondering where the market bottom is, JPMorgan has some good news. The bank sees companies continuing to buy back their shares, which could help stocks establish a bottom. “In the latest sell-off, JPM estimates 3-4x higher buyback executions than trend, which implies the corporate put remains active,”… Source link

Read More »Amundi Turning Bullish on China Stocks, Still Cautious on Tech

(Bloomberg) — Investors should be ready for China’s stocks to outperform as potential positive catalysts loom, according to Europe’s largest asset manager Amundi SA. Most Read from Bloomberg The firm is turning more bullish on the country’s equities market after trimming exposure during the first quarter’s harsh selloff, according to Vincent Mortier, Amundi’s chief investment officer. Key developments to watch include the potential rollout of a homegrown mRNA Covid-19 vaccine and… Source link

Read More »Jim Cramer says ‘leaving the market is a mistake’ — here’s what he’s most bullish on right now

Jim Cramer says ‘leaving the market is a mistake’ — here’s what he’s most bullish on right now The S&P 500 is down 10% over the past month alone. According to CNBC’s Jim Cramer, the recent plunge in stocks reflects a lack of investor confidence in the Federal Reserve. He says these investors believe that the Fed has lost control or is helpless to fix things given the state of the global supply chain. But Cramer remains bullish — particularly on Fed Chairman Jerome Powell. “I think… Source link

Read More »The most bullish story in the stock market right now: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Friday, April 8, 2022 Today’s newsletter is by Sam Ro, the author of TKer.co. Follow him on Twitter at @SamRo. Before tensions escalated between Ukraine and Russia in February, a bullish stock market story had been unfolding: Wall Street analysts were revising up their forecasts for 2022 and 2023 corporate earnings. Since then, geopolitical risks… Source link

Read More »Is the stock market flashing a net bullish sign?: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Monday, April 4, 2022 “Cash is trash,” billionaire Ray Dalio told me in a chat recently (more on that below). And he may be right as it pertains to the current investing backdrop. Cash allocations are almost two times more than last year’s levels, according to new data out of Bank of America. The data looks at the average recommended allocation to… Source link

Read More »The bullish case for the S&P 500 investors are ignoring: DataTrek

With the threat of anticipated rate hikes by the Federal Reserve still looming over markets, plenty of uncertainty remains as investors are tentative as to whether the recent partial recovery from the larger January downturn may be an instance of a “dead cat bounce.” According to DataTrek Research, there are several key reasons for a bullish case for large-cap equities that investors may be ignoring. “As much as Fed policy remains an overhang on US large cap stocks, there is a valid… Source link

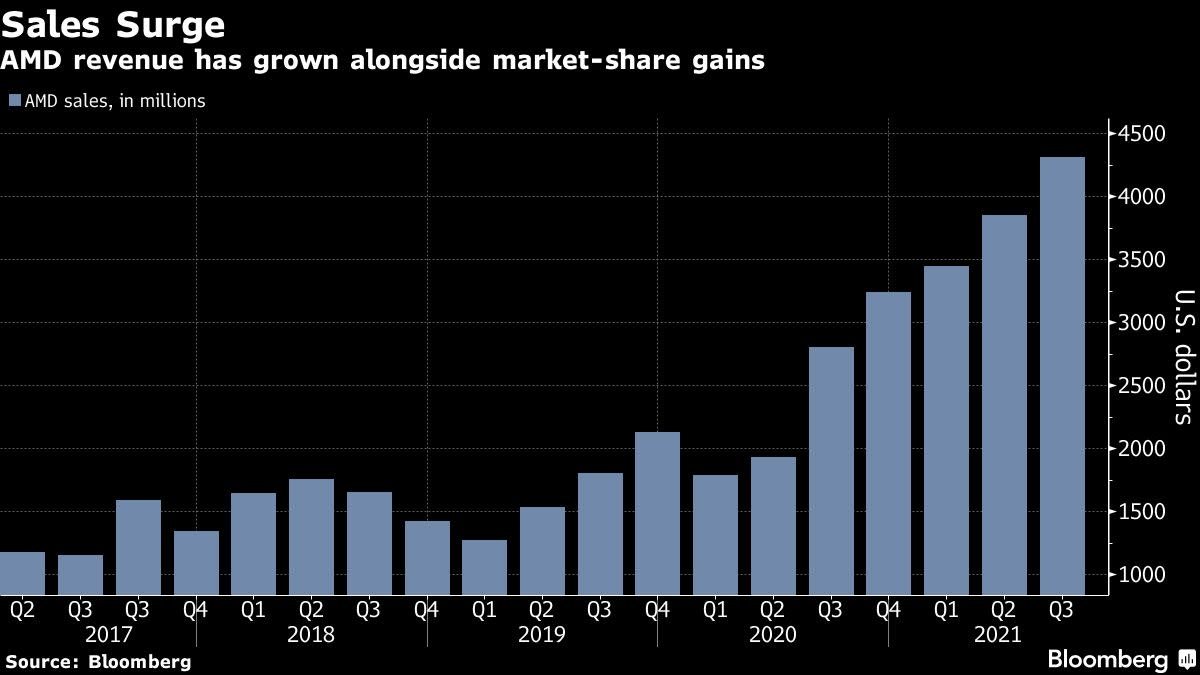

Read More »AMD’s Bullish Outlook Suggests It’s Gaining Further on Intel

(Bloomberg) — Advanced Micro Devices Inc. rallied as much as 12% in late trading after giving a surprisingly strong sales forecast, suggesting it’s making further gains on archrival Intel Corp. in computer processors. Most Read from Bloomberg The chipmaker’s first-quarter sales outlook outpaced Wall Street estimates on Tuesday, and AMD is reaching a level of profitability that’s nearly identical to Intel’s — something that would have been inconceivable just a few years ago…. Source link

Read More »