This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Friday, July 8, 2022 Today’s newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. One of the biggest bulls on Wall Street has finally pared back their optimism for the rest of this year. In a note to clients published Thursday, Oppenheimer Asset Management Chief Investment… Source link

Read More »Oppenheimer’s Bull Case Sees S&P 500 Rebounding to $4,800 — Here Are 2 of the Firm’s Top Picks

Warren Buffett famously said one should be fearful when others are greedy and be greedy when others are fearful. Right now, there is a lot of fear around stocks, with an 18% year-to-date loss on the S&P 500 index – and that’s after gaining 3% in recent trading sessions. Does that mean it’s time to get greedy? Perhaps a hint is coming in from Oppenheimer. The firm is less pessimistic than most, and in recent note, chief investment strategist John Stoltzfus lays out a bull case for gains… Source link

Read More »Long-time bull Cathie Wood warns investors about the ‘big problem’ in the economy. Here’s what she likes today

‘We are in a recession’: Long-time bull Cathie Wood warns investors about the ‘big problem’ in the economy. Here’s what she likes today The official GDP estimate for Q2 won’t be available until later next month, but many experts – including Ark Invest’s Cathie Wood – are calling for a recession. “We think we are in a recession,” Wood says in a recent CNBC interview. “We think a big problem out there is inventories — the increase of which I’ve never seen this large in… Source link

Read More »Wall Street vet and Bitcoin bull Mike Novogratz says the economy is going to ‘collapse’ and we’re heading into a ‘really fast recession’

While many economists agree a recession is likely coming in 2023, Wall Street veteran and Bitcoin bull Mike Novogratz has just given one of the most dire outlooks yet. “The economy is going to collapse,” Novogratz told MarketWatch on Wednesday, adding, “We are going to go into a really fast recession, and you can see that in lots of ways.” Novogratz, chief executive of crypto merchant bank Galaxy Digital, gave the interview just before the Federal Reserve raised rates by 0.75… Source link

Read More »Netflix’s subscriber loss is a ‘body blow to the bull case’

Make no mistake: The drop in Netflix’s (NFLX) subscriber count is a major setback for the company, Manhattan Venture Partners Head of Research Santosh Rao told Yahoo Finance (video above). “This is a body blow to the bull case — definitely to the Netflix story, the subscriber story,” said Rao. “Netflix was all about subscribers for so long… and it’s really taking it on the chin here.” Netflix’s stock tanked in response to its latest round of earnings, as shares dropped by more… Source link

Read More »Is the bull market over? Probably not, strategist says

Although the S&P 500 (^GSPC) has yet to return to the peaks it reached around the turn of the new year, the stock market has recently gained traction to bounce back from mid-March lows. LPL Financial (LPLA) Chief Market Strategist Ryan Detrick provided some context surrounding the current state of the market with regard to bull markets seen in prior decades. “We looked at 11 bull markets since World War II. Once they got to the third year, three of those 11 actually died. In other words, a… Source link

Read More »Yandex Stock: Bear vs. Bull

Yandex ( YNDX -6.79% ), one of Russia’s largest tech companies, lost 40% of its market value over the past 12 months as it grappled with an antitrust probe, concerns about its net losses, rising interest rates, and the Ukrainian conflict sparking an exodus from Russian equities. But after that steep sell-off, Yandex trades at just 2.2 times this year’s sales. That seems like a very low valuation for one of Russia’s largest online search, ride-hailing, e-commerce, and… Source link

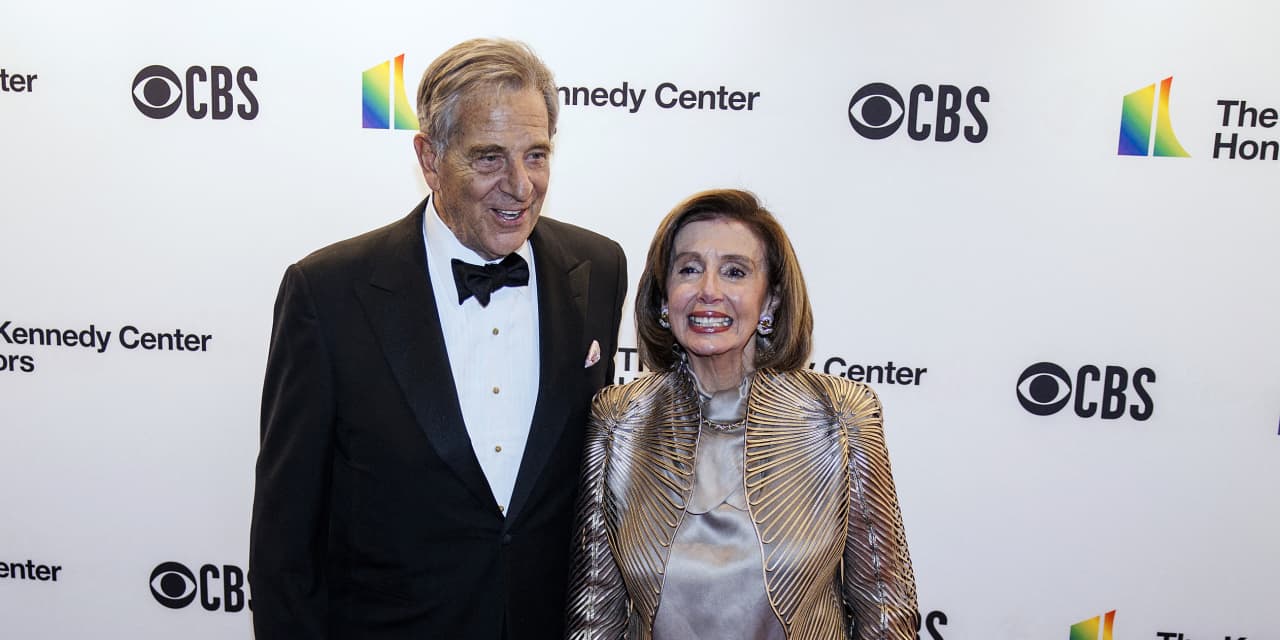

Read More »Pelosi’s husband bought Google, Disney call options that would pay off if bull market continues

U.S. House Speaker Nancy Pelosi’s husband may be be positioning himself to profit from the ongoing rise in the share prices of some of America’s biggest companies. Paul Pelosi, the California Democrat’s spouse, bought call options that give him the right, but not the obligation, to purchase shares in Google parent Alphabet, Inc. GOOG, -0.04%, memory-chip company Micron Technology Inc. MU, -2.01%, Salesforce.com… Source link

Read More »Why this big bull sees the stock market stampeding higher in 2022

Oppenheimer chief investment strategist John Stoltzfus is in rarified air on Wall Street entering the New Year. The long-term market forecaster now sports the most bullish price target on the S&P 500 amongst his peers, eclipsing the always optimistic Brian Belski at BMO Capital Markets. Stoltzfus — who has spent 38 plus years on the Street — sees the S&P 500 climbing 14% to 5,330 by the end of 2022. Belski forecasts S&P 500 5,300. Through Wednesday, the S&P 500 is up 24%… Source link

Read More »Bitcoin bull run shows signs of wear as crypto investors eye other coins; Omicron, Fed taper loom

The volatile but never boring market for Bitcoin (BTC) has been whipsawed in recent days, as investors ponder whether there are better returns to be had in other cryptocurrencies, even as a new COVID-19 variant and the Federal Reserve’s policy outlook shake up the landscape. With news of the Omicron strain of COVID-19 unsettling investors, Bitcoin shed over 2% on Tuesday as Fed Chairman Jerome Powell dropped several hints that the central bank is growing more attentive to inflationary risks,… Source link

Read More »