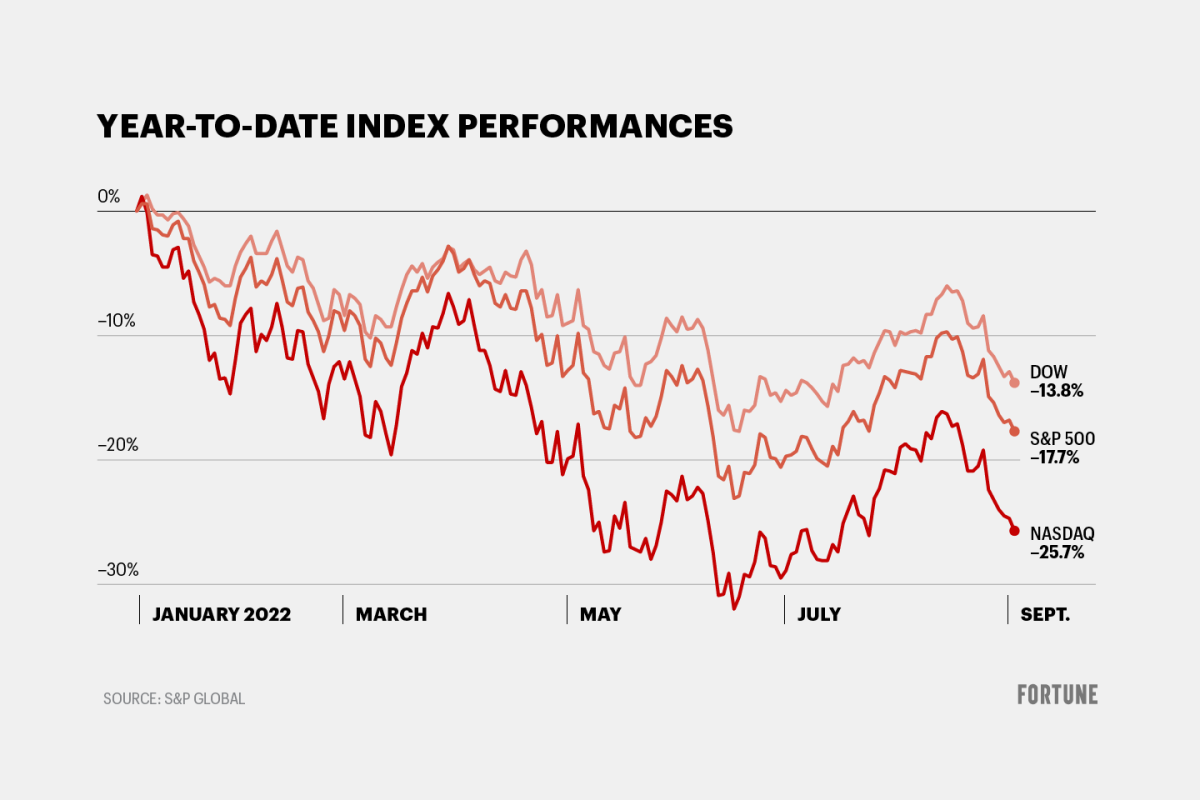

The S&P 500’s decline this year—it’s down nearly 18% since January—accelerated last week after Federal Reserve Chair Jerome Powell indicated more “pain” was ahead. Has the market hit bottom? Bank of America Research, based on its new list of 10 signals showing whether the stock market has hit bottom, says no. View this interactive chart on Fortune.com The bank came up with the list, released on Friday, after analyzing “macro and bottom-up data encompassing policy, valuation,… Source link

Read More »‘We believe that we are at the bottom’

Intel CEO Pat Gelsinger says things are unlikely to get worse at the company than the surprising challenges seen in a disappointing second quarter. “We believe that we are at the bottom,” Gelsinger said on Yahoo Finance Live on Friday (video above). “We have said that very plainly, that we are below the shipping rates of our customers. So we see that building back naturally. Also as we go into the second half you have some of the natural cycles like holidays as well. So all of those give us… Source link

Read More »Calling a bottom on the Biden presidency

I’m gonna set myself up here. Big time. In the next few paragraphs, I’m going to make the case for why Joe Biden’s presidency has hit its low point and is going to recover, a bit. Biden haters are going to bombard me with invective, claiming Biden is senile and whatever other trash Fox News has been running lately. Bring it. A steady drumbeat of bad news has forced Biden’s approval rating below 39%, which is three points lower than Donald Trump’s approval rating at the same point in… Source link

Read More »The bottom of the bear market is still 10% away, Morgan Stanley Wealth Management says. And the odds of a recession have doubled, too

The stock market is off to one of its worst starts ever this year, with the S&P 500 falling more than 20% year to date. It’s a rout that has left many investors wondering when they will be able to “buy the dip.” Morgan Stanley Wealth Management’s Lisa Shalett says don’t hold your breath. The chief investment officer believes stocks have more room to fall as many companies have yet to change their earnings forecasts after the Federal Reserve’s decision to increase the pace of its… Source link

Read More »Is this a bear market trap or a stock market bottom?

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Today’s newsletter is by Brian Sozzi, an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn. Monday, June 27, 2022 I am rather amazed by the powerful effects of taking my first day off in about four years last week. What’s left is a (mostly) clear head with physical batteries that are more charged up… Source link

Read More »JPMorgan says the market bottom is near as corporate buybacks skyrocket — here are 3 high-upside stocks to play that bullish sentiment

JPMorgan says the market bottom is near as corporate buybacks skyrocket — here are 3 high-upside stocks to play that bullish sentiment Stocks have fallen quite a bit in 2022. If you are wondering where the market bottom is, JPMorgan has some good news. The bank sees companies continuing to buy back their shares, which could help stocks establish a bottom. “In the latest sell-off, JPM estimates 3-4x higher buyback executions than trend, which implies the corporate put remains active,”… Source link

Read More »There won’t be a ‘v-shaped bottom’ in this market

On Friday, the S&P 500 broke a 7-week losing streak, the index’s longest since 2001. Concerns about a slowing economy and tighter monetary policy from the Federal Reserve have been at the center of this decline. Last week’s rebound likely has some investors wondering if the worst is over for stocks, and asking if we’re set to see a comeback similar to what followed the pandemic-induced bear market of 2020. One strategist, however, doesn’t see the ingredients for this kind of rebound in the… Source link

Read More »The key stock to watch for the market bottom: Morning Brief

Subscribe Wednesday, May 11, 2022 Today’s newsletter is by Emily McCormick, a reporter for Yahoo Finance. Follow her on Twitter As volatility grips markets, investors are naturally wondering when the selling will abate and the bottom will be put in. According to a number of pundits, the answer is probably not quite yet. Stocks have fallen sharply for the year-to-date and in the past several weeks especially. The S&P 500 has tumbled 16% so far in 2022, and by a slightly more pronounced 16.6% from… Source link

Read More »Time to Bottom Fish? 3 ‘Strong Buy’ Stocks That Are Down Around 50% This Year

What to make of the markets right now? Last week brought more losses in what’s been a volatile year for stocks. The five straight weeks of market declines marked the longest such streak in over a decade. More ominously, they came in along with a number of other disturbing data points. The April jobs numbers, released on Friday, came to 428,000 jobs added for the month, superficially strong and well above the 391,000 expected. But the labor remains depressed, and the total number of workers,… Source link

Read More »How Covid Travel Restrictions Boosted Google’s Bottom Line

Confusion has led to a six-fold increase in searches related to Covid-related travel restrictions. getty Google search trends offer not only a fascinating window into the public’s most pressing questions, but they can also be a huge indicator of what’s driving ad dollars for the tech behemoth. Simply put, the more searches for a given topic, the more eyeballs that land on related ads. It’s nearly impossible to overestimate how the Covid-19 pandemic has impacted what… Source link

Read More »