(Bloomberg) — Speculators cleaving to the view that the crypto rout is mostly over are at risk of a rude awakening in 2023, according to Standard Chartered. Most Read from Bloomberg A further Bitcoin plunge of about 70% to $5,000 next year is among the “surprise” scenarios that markets may be “under-pricing,” the bank’s Global Head of Research Eric Robertsen wrote in a note on Sunday. Demand could switch from Bitcoin as a digital version of gold to the real thing, spurring to a 30%… Source link

Read More »Bitcoin little changed, Dogecoin leads pack in muted morning of trading

Bitcoin was little changed in Monday morning trading amid mixed results from the other top 10 non-stablecoin cryptocurrencies following a relatively muted few days of trading over the Thanksgiving weekend in the U.S. Memecoin Dogecoin was the standout performer as longtime token advocate and new Twitter Inc. boss Elon Musk used the platform to announce a significant development for his electric car company Tesla Inc. See related article: Binance releases proof of reserves Fast facts Bitcoin… Source link

Read More »Bitcoin, crypto rise as FTX contagion fears ease

Bitcoin recovered above US$16,000 in Wednesday morning trading as it rose along with Ether and the rest of the crypto top 10 by market capitalization, excluding stablecoins, as the market shook off lingering doubts from earlier in the week of further contagion from the now-bankrupt crypto exchange FTX. See related article: Cathie Woods buys the dip as Ark Invest scoops up Coinbase, GBTC shares: Bloomberg Fast facts Bitcoin rose 2.6% to US$16,198 in the 24 hours to 8 a.m. in Hong Kong, while… Source link

Read More »Bitcoin, other crypto start week lower as FTX collapse continues rumble through the industry

Bitcoin and Ether both fell in Monday morning trading in Asia along with all of the top 10 non-stablecoin cryptocurrencies by market capitalization. With the exception of XRP, all the top 10 also lost ground over the last seven days as more details emerged about the failure of the FTX exchange. In addition, FTX appealed to other exchanges to help track the hacker who stole an estimated US$600 million from the Bahamas-based exchange and began moving the funds into other tokens. See related… Source link

Read More »A year since its $69K peak, Bitcoin has plummeted more than 70% — here’s why Warren Buffett has hated cryptocurrency all along

‘They will come to a bad ending’: A year since its $69K peak, Bitcoin has plummeted more than 70% — here’s why Warren Buffett has hated cryptocurrency all along It’s been a tough year for Bitcoin and its backers. And even back in 2018, the Oracle of Omaha predicted that it and other cryptocurrencies were headed for trouble. “They will come to a very bad ending,” Warren Buffett told CNBC at the time. After hitting an all-time peak of around $69,000 per unit on November 10, 2021, the world’s… Source link

Read More »Bitcoin, crypto plunge as FTX-Binance deal raises contagion concerns

Cryptocurrencies plunged Tuesday as investors digested an emergency deal struck for an undisclosed sum between major crypto exchanges Binance and FTX. Bitcoin (BTC-USD) tumbled 13% over the last 24 hours from $19,800 to a period low of $17,603, the largest one-day drop since June. It has since recovered above $18,600 per coin. The second largest cryptocurrency, ether (ETH-USD) sold off by 15% on the day from $1,468 to $1,318. FTX’s exchange token FTT, fell by as much as 84% on the day from… Source link

Read More »Core Scientific shares fall 76% after the bitcoin miner warns it can’t pay debt

Core Scientific (CORZ) will not make debt payments due in October and November, according to a new securities filing. Shares of the bitcoin mining company were down as much as 76% on Thursday morning. Core said it’s exploring alternatives to its capital structure and is working with financial and legal advisers but noted that it might have to file for bankruptcy. — in which case common stock holders would completely lose their investments. “Given the uncertainty regarding the Company’s… Source link

Read More »‘This lawsuit isn’t about bitcoin’

Grayscale Investments filed its first brief last week in its legal battle with the Securities and Exchange Commission over the agency’s refusal to let it convert its bitcoin fund into an exchange-traded fund. In an interview Monday for Yahoo Finance’s All Markets Summit, Grayscale CEO Michael Sonnenshein says that the litigation transcends its own attempts to launch a spot bitcoin ETF. “We really feel that this lawsuit isn’t about bitcoin,” Sonnenshein told Yahoo Finance’s… Source link

Read More »Sustainable Bitcoin Protocol Wants to Make Bitcoin a Climate-Positive Asset

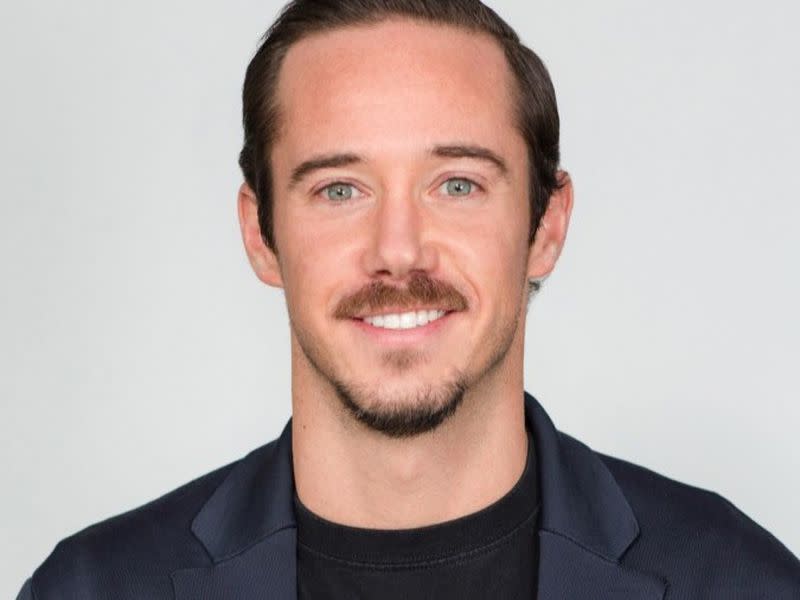

Addressing Bitcoin’s energy-intensive proof-of-work model would encourage greater institutional adoption, according to one chief executive who has focused on sustainability for more than eight years. Bradford Van Voorhees, CEO and co-founder of Sustainable Bitcoin Protocol, told CoinDesk that negative media, misperceptions of Bitcoin’s environmental impact and its sizable energy consumption all currently hinder institutional adoption. Bradford Van Voorhees is presenting at Investing in… Source link

Read More »Bitcoin Becoming Less Volatile Than Stocks Raises Warning Flag

(Bloomberg) — At first blush, Bitcoin becoming less volatile than stocks might appear like a positive development. But crypto traders are warning that in a low-volume environment, that might not be a great thing. Most Read from Bloomberg The coin’s 30-day realized volatility has “dropped sharply” in recent days, according to Noelle Acheson, author of the “Crypto is Macro Now” newsletter. It’s currently at around 52% after spending the past month above 64% on an annualized basis,… Source link

Read More »