The 2022 Rivian R1T.Tim Levin/Insider Layoffs at EV startup Rivian began this week. The company is cutting costs amid its production ramp-up and concerns about the economy. Former employees are posting on LinkedIn about the cuts, which impacted non-manufacturing roles. Layoffs at Rivian started in late July as the electric vehicle startup races to cut costs amid a challenging economic climate and pressure to increase production. Dozens of workers who say they are now-former employees have… Source link

Read More »Chips bill advances in the Senate — Here’s what’s in the $79 billion legislation

After more than a year of negotiations, Congress is on the cusp of passing a bill to alleviate the chip shortage and shore up U.S. competitiveness with China — in part by giving $50 billion to the semiconductor industry. The Senate voted 64-32 on Tuesday to end debate on the so-called “CHIPS+” bill. This key step, which required 60 votes, now sets the stage for final passage in the coming days. As the key procedural step got underway, Senate Majority Leader Chuck Schumer (D-NY) said the… Source link

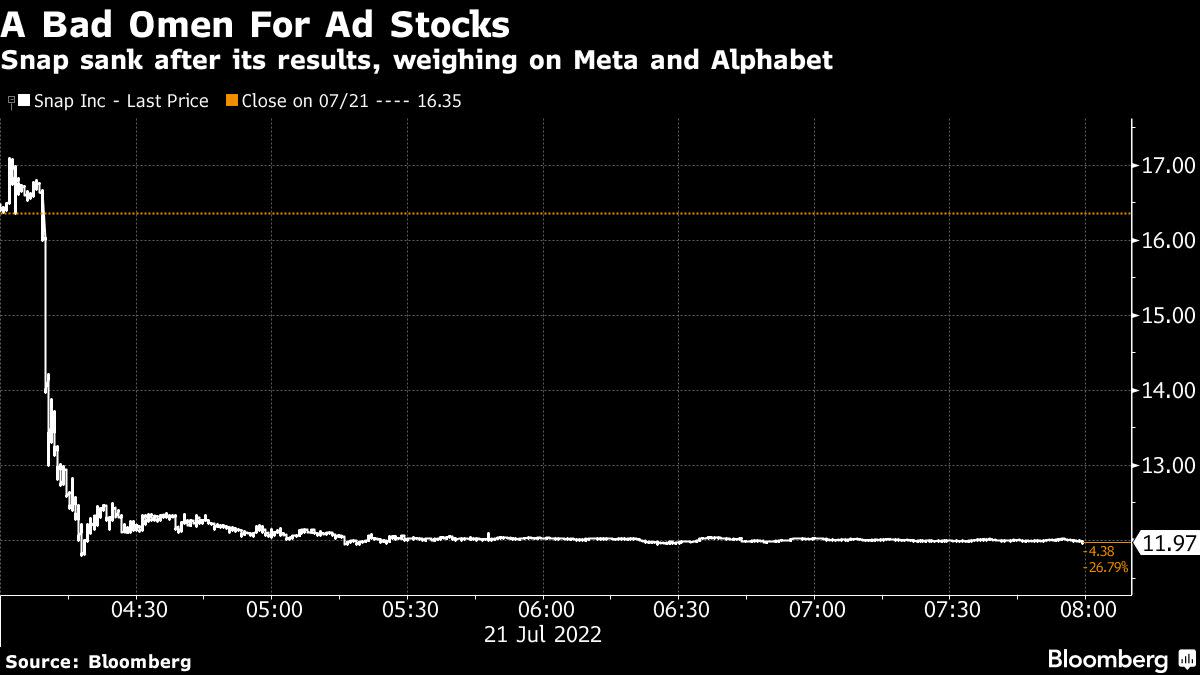

Read More »‘Awful’ Snap Sales Wipe $76 Billion From Social Media Stocks

(Bloomberg) — US social-media giants were poised to see more than $76 billion wiped off their stock-market values Friday after disappointing revenue from Snap Inc. raised concerns about the outlook for online advertising. Most Read from Bloomberg The Snapchat parent plummeted as much as 30% in premarket trading. Meanwhile, Facebook parent Meta Platforms Inc. fell 4.8%, Google owner Alphabet Inc. declined 2.8%, Twitter Inc. slipped 2.5% and Pinterest slumped 7.2%. The losses mark the second… Source link

Read More »Why Amazon’s acquiring this health care company for $3.9 billion

Amazon (AMZN) announced today that it would acquire subscription health care provider One Medical for $3.9 billion. The deal marks one of Amazon’s most high-profile pushes into health care to date. So, why One Medical? To start, One Medical — which was founded in 2007 and focuses on so-called concierge primary care — was on the market. The company had reportedly been fielding takeover interest from giants like CVS (CVS). One Medical’s $199 annual subscription offers 24/7 access to… Source link

Read More »China’s billionaires want to flee the country, and take $60 billion of wealth with them on their way out

Last month, Shanghai-based billionaire Yimeng Huang—the CEO and chairman of gaming company XD—announced in a company memo that he and his family would relocate from China. The note leaked onto the internet and went viral on Chinese social media, sparking netizen discussions on the growing number of prominent businesspeople leaving China. “I’m preparing my family to move abroad by next year. It’s still a plan though, and anything can happen in a year. I’m prioritizing both my… Source link

Read More »Congress deliberates a $52 billion semiconductor bill — Here are 2 stocks that could benefit

In today’s world, the markets cannot be separated from politics. Case in point – the semiconductor subsidy bill currently before Congress. The bill, which holds the promise of some $52 billion worth of subsidies for the US semiconductor industry, was stalled in the Congressional processes for several months but last week got a boost from House Speaker Nancy Pelosi. In a move not sees as particularly coincidental, Pelosi’s husband just last month exercised a call option to purchase more… Source link

Read More »Bill Ackman to wind up SPAC, return $4 billion to investors

By Svea Herbst-Bayliss, Anirban Sen and Arunima Kumar NEW YORK (Reuters) -Billionaire investor William Ackman, who had raised $4 billion in the biggest-ever special purpose acquisition company (SPAC), told investors he would be returning the sum after failing to find a suitable target company to take public through a merger. The development is a major setback for the prominent hedge fund manager who had initially planned for the SPAC to take a stake in Universal Music Group last year when… Source link

Read More »Elon Musk’s decision to pull a $44 billion deal for Twitter could see Wall Street’s top banks lose hundreds of millions of dollars, scuppering one of 2022’s biggest pay days.

Britta Pedersen/Getty Images; Twitter; Rachel Mendelson/Insider Elon Musk’s decision to kill the $44 billion Twitter deal means banks could lose a “nine-figure” payday. Musk’s and Twitter’s financial advisors could pocket up to $192 million if the deal closes. The billionaire faces an uphill battle to call off the deal as he has to prove there’s been a material adverse effect on the transaction. Elon Musk’s ‘will-he-won’t-he’ dance to buy Twitter took a turn on Friday after the billionaire said… Source link

Read More »How Elon’s bizarre Twitter takeover saga could have just been a cover for him to sell $8.5 billion in Tesla stock

Elon Musk on Friday announced he was backing out of his $44 billion Twitter acquisition bid, blaming the social media platform’s alleged lack of transparency regarding bots on the site. As both sides prepare for a lengthy court battle, some Twitter influencers are floating an alternate theory for the change of heart: The bots were never the problem, merely a vehicle through which to covertly sell Tesla options that were about to expire. “Entire thing was a clever ruse to SELL + LIQUIDATE $8.5… Source link

Read More »Twitter vows legal fight after Musk pulls out of $44 billion deal

By Greg Roumeliotis (Reuters) – Elon Musk, the chief executive officer of Tesla and the world’s richest person, said on Friday he was terminating his $44 billion deal to buy Twitter because the social media company had breached multiple provisions of the merger agreement. Twitter’s chairman, Bret Taylor https://twitter.com/btaylor/status/1545526087089696768?s=20&t=7sx_IvK_zZkztdHdh8pwQQ, said on the micro-blogging platform that the board planned to pursue legal action to enforce the merger… Source link

Read More »