(Bloomberg) — One of Wall Street’s most prominent bears sees the current rally in US stocks extending — prior to the selloff recommencing. Most Read from Bloomberg Morgan Stanley strategists led by Michael Wilson say the S&P 500 Index may climb another 5% to 7%, before resuming losses. “We think US equity markets can rally further,” they wrote in a note, with a decline in both bond yields and oil prices having eased some worries around runaway inflation and helping the benchmark snap a… Source link

Read More »2 Big Dividend Stocks With 9% Yield; Raymond James Says ‘Buy’

Inflation data dominated the market news at the end of last week, and rightly so. The May print, of 8.6% annualized gains in the consumer price index, marked a sharp reversal from the modest decline seen in April, and a new ‘highest level in 40 years’ data point. It reignited worries that the rosy projections – of a transient inflation, or of lower rates by early next year – are unlikely to reach fruition. Even though unemployment is low and wages are up, the declines in real… Source link

Read More »The stock market’s next big problem? Corporate earnings.

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Tuesday, June 7, 2022 Today’s newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. Earnings season may be done, but corporate results are set to be the stock market’s next big problem. Again. In a note to clients published Monday, Morgan Stanley strategist Mike Wilson noted… Source link

Read More »Amber Heard lost her defamation case with Johnny Depp because she wasn’t believable and not as big of a star, experts say

Amber Heard.EVELYN HOCKSTEIN/POOL/AFP via Getty Images A jury largely sided with Johnny Depp in his defamation trial with Amber Heard on Wednesday. Experts told Insider that Heard lost because she wasn’t believable on the stand, and isn’t as big a star. “The jurors loved him, the public loved him, everyone on social media loved him.” Amber Heard lost her defamation case with Johnny Depp because she didn’t come off as credible, and lacks her ex-husband’s star power, experts told Insider hours… Source link

Read More »Should I buy this big dip? Warren Buffett has spent a third of his cash hoard — so it might be a sharp idea to start nibbling

Should I buy this big dip? Warren Buffett has spent a third of his cash hoard — so it might be a sharp idea to start nibbling Warren Buffett is back in his element. After sitting on a growing cash pile for years, Buffett is finally opening up his wallet. The Oracle of Omaha deployed $51 billion in the first three months of this year. That’s roughly one-third of the cash pile his company, Berkshire Hathaway, had at the end of 2021. Here are all the stocks he added to the portfolio in the… Source link

Read More »The commercialization of Juneteenth backfires for big brands

Large corporations that initially sought to cash in on Juneteenth-themed items ahead of the new federal holiday on are now walking back their commercialization efforts after backlash on social media. On Tuesday, Walmart said it would remove its store-brand ice cream celebrating Juneteenth amid growing condemnation of the retailer trivializing the day for profit. “Juneteenth holiday marks a celebration of freedom and independence,” the company said in a statement. “However, we received feedback… Source link

Read More »JPMorgan employees describe growing ‘paranoia’ as the company tracks their office attendance, calls, calendars, and more — with one worker even installing a ‘mouse jiggler’ to evade ‘Big Brother’

JPMorgan Chase CEO Jamie Dimon. Employees at the bank say suspicion and fear are swirling over the firm’s data-collection efforts.KENA BETANCUR/Getty Images JPMorgan has developed a powerful data-collection tool to monitor its employees’ activities. Employees at America’s largest bank fear what the data collection could mean for their jobs. One staffer described a workplace where terms like “Big Brother” and “1984” have become commonplace. At JPMorgan Chase, employees say watchful eyes are… Source link

Read More »Ride Sharing Market Next Big Thing

Latest published market study on Ride Sharing Market provides an overview of the current market dynamics in the Ride Sharing space, as well as what our survey respondents—all outsourcing decision-makers—predict the market will look like in 2027. The study breaks market by revenue and volume (wherever applicable) and price history to estimates size and trend analysis and identifying gaps and opportunities. Some of the players that are in coverage of the study are DiDi, Uber,… Source link

Read More »Big retailers might soon be forced to offer big discounts

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, May 19, 2022 Today’s newsletter is by Brian Cheung, an anchor and reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz. Yesterday, Target’s (TGT) earnings were a huge whiff. The stock market did not care for this news, and equities across the board tanked with the S&P 500 turning in… Source link

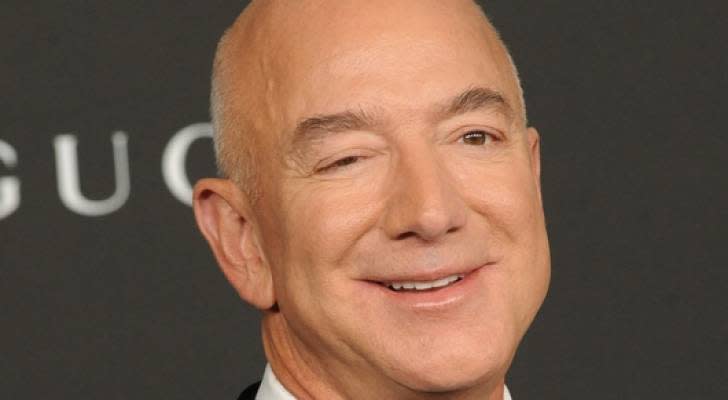

Read More »Billionaires like Jeff Bezos and Bill Gates are making big bets on farmland — here are 2 effortless ways you can access it, too

Billionaires like Jeff Bezos and Bill Gates are making big bets on farmland — here are 2 effortless ways you can access it, too Fear is taking over. The S&P 500 is down about 16% of its value in 2022, while the tech-heavy Nasdaq has lost 26% over the same period. Investors are worried about rising interest rates, supply chain issues, and an economic slowdown. Billionaires are nervous, too. But they do have access to an asset class that has a proven track record of wealth protection:… Source link

Read More »