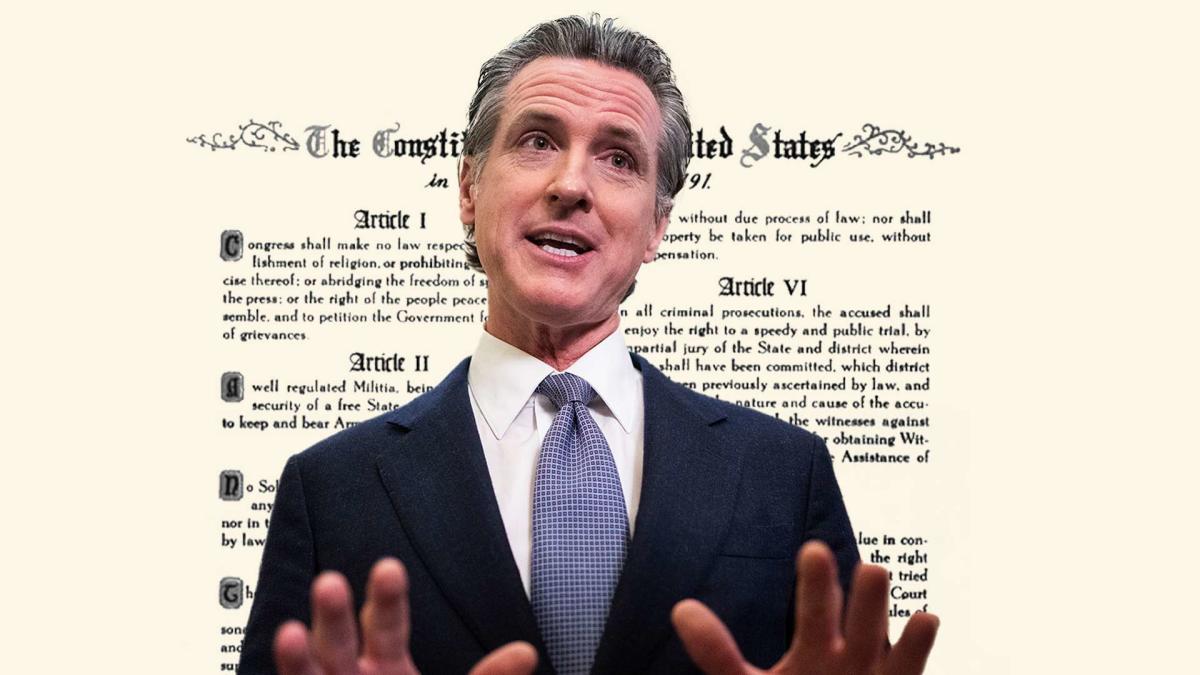

California Gov. Gavin Newsom thinks the Constitution should be amended to accommodate the gun regulations he favors. But in the meantime, he is trying out a different strategy: If we ignore the Second Amendment, maybe it will go away. In 2022, the U.S. Supreme Court upheld the right to carry guns in public for self-defense, saying states could not require residents to demonstrate a “special need” before allowing them to exercise that right. Newsom responded to what he called a “very bad… Source link

Read More »Why the bear market hasn’t bottomed yet, according to one top forecaster

The bulls probably don’t want to hear this, but the bottom for this current bear market cycle may not be in place yet. “Frankly, the history of bear markets is such that when you think about it in the context of that October low that we had, no bear market has ever bottomed before the recession started,” Julian Emanuel, strategist at Evercore ISI, pointed out on Yahoo Finance Live (video above). “We don’t necessarily need to see the full breadth and depth of the recession — we need to see… Source link

Read More »Why this Wall Street bear says it’s time to sell stocks again

One of the market’s biggest skeptics is going back to his old ways. Morgan Stanley strategist Mike Wilson cautioned that the rally that has enveloped markets in recent weeks is long in the tooth and overdue for a breather. “As predicted, falling interest rates at the back end have led to modest, further gains for this bear market rally,” Wilson wrote in a new note on Monday. “However, with last week’s price action, the S&P 500 is now right into our original tactical target range of 4000-4150…. Source link

Read More »Why this Wall Street bear says it’s time to sell stocks again

One of the market’s biggest skeptics is going back to his old ways. Morgan Stanley strategist Mike Wilson cautioned that the rally that has enveloped markets in recent weeks is long in the tooth and overdue for a breather. “As predicted, falling interest rates at the back end have led to modest, further gains for this bear market rally,” Wilson wrote in a new note on Monday. “However, with last week’s price action, the S&P 500 is now right into our original tactical target range of 4000-4150…. Source link

Read More »Tesla stock bear surprises with upgrade after $600 billion rout

Tesla stock woes have caught the attention of one noted Wall Street bear on the EV maker. Citi analyst Itay Michaeli upgraded his rating on Tesla to Neutral from Sell on Wednesday, viewing the company losing more than $600 billion in market cap from November 2021 highs as nearing overdone. “We believe the year-to-date pullback has balanced out the near-term risk/reward,” Michaeli wrote in a note to clients. The analyst served up several reasons for the valuation-based upgrade. “(1) With the… Source link

Read More »‘The bear market is not over,’ according to Goldman Sachs

The feel good vibes in the markets this holiday season may be coming to an end, warns Goldman Sachs. “The bear market is not over, in our view,” closely followed Goldman Sachs strategist Peter Oppenheimer wrote in a new note. “The conditions that are typically consistent with an equity trough have not yet been reached. We would expect lower valuations (consistent with recessionary outcomes), a trough in the momentum of growth deterioration, and a peak in interest rates before a sustained… Source link

Read More »A Netflix bear is suddenly Wall Street’s biggest bull — here’s why

There’s a renewed bullish fever in Netflix (NFLX) stock following a better-than-feared third quarter and outlook as well as optimism around a major profit boost from the soon-to-launch ad-supported network. Netflix stock has surged 51% in the past six months, blowing away the 7% drop for the S&P 500. That fiery advance coupled with new fundamental drivers won over Wall Street’s biggest Netflix bear on Wednesday: Pivotal Research Analyst Jeff Wlodarczak. Wlodarczak aggressively hiked his… Source link

Read More »Jamie Dimon’s S&P 500 Bear Market: Brutal, Far From Unimaginable

(Bloomberg) — Jamie Dimon says don’t be surprised if the S&P 500 loses another one-fifth of its value. While such a plunge would fray trader nerves and stress retirement accounts, history shows it wouldn’t require any major departures from past precedents to occur. Most Read from Bloomberg Judged by valuation and its impact on long-term returns, the JPMorgan Chase chief executive officer’s “easy 20%” tumble would result in a bear market that is in many regards normal. A decline… Source link

Read More »Stocks bear market ‘will continue into the first quarter,’ portfolio manager says

Battered investors hoping for a reprieve from the teeth of the bear market may have to wait until early 2023. That’s the blunt assessment from Pimco portfolio manager Erin Browne. “I think it [the bear market] will continue into the first quarter of next year because the Fed is going to keep hiking [rates],” Browne warned on Yahoo Finance Live (video above). “And so it’s hard to have with any certainty right now what next year will bring.” That’s hardly welcome analysis in what has been a… Source link

Read More »Here’s one veteran strategist’s guess at a bear market bottom

Investors would be wise to buckle up for more downside to an already battered stock market, veteran CFRA Chief Investment Strategist Sam Stovall warns. “I think this will be a bear market with a recession,” Stovall said on Yahoo Finance Live (video above). “Bear markets with recessions have ended up being deeper and lasting longer than those without a recession, with the average decline being 35%. So I think we will probably end up seeing this bear market bottom around 3,200.” Stovall’s… Source link

Read More »