Some firms across the financial industry are giving workers the boot after dealmaking activity tumbled last year and as a potential recession looms. But the picture among Wall Street’s six biggest banks is mixed when it comes to the scale of these layoffs. And some firms are even adding staff in this environment — as JPMorgan chief Jamie Dimon said last week, his bank is in “hiring mode.” Along with financial results for the fourth quarter, Goldman Sachs (GS) and Morgan Stanley (MS) each… Source link

Read More »Big banks set aside $4 billion for a recession. Investors are more optimistic: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox by signing up here. Saturday, January 14, 2022 Today’s newsletter is by Myles Udland, Head of News at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. Read this and more market news on the go with Yahoo Finance App. Big banks including JPMorgan, Wells Fargo, Citigroup, and Bank of America all reported quarterly results on Friday. These firms collectively sent a clear message to… Source link

Read More »Stocks edge lower as big banks report earnings

U.S. stocks fell in early-morning trading amid key earnings reports from financial heavyweights. The S&P 500 (^GSPC) was down 0.8%, while the Dow Jones Industrial Average (^DJI) was off by 0.6%. The technology-heavy Nasdaq Composite (^IXIC) declined by roughly 0.8%. The yield on the benchmark 10-year U.S. Treasury ticked up slightly to 3.47%. The dollar index ticked up 0.21% to $102.21. Stocks pared early losses after the U.S. Michigan consumer sentiment survey for January rose to a nine-month… Source link

Read More »Former Morgan Stanley CEO on Swiss banks: Secrecy is ‘their nature’

In 2014, Credit Suisse pleaded guilty to helping thousands of Americans evade taxes and paid a $2.6 billion fine. It also promised to reveal any hidden bank accounts. Credit Suisse has recently come under scrutiny by the U.S. Department of Justice for potentially not complying with that plea agreement, the Wall Street Journal reported last week, citing unnamed sources familiar with the matter. Former Morgan Stanley CEO John Mack, who last month published “Up Close and All In: Life Lessons… Source link

Read More »China tells state banks to prepare for a massive dollar dump and yuan buying spree as Beijing’s prior interventions have failed to stem its currency’s worst year since 1994

Chinese President Xi Jinping.Kevin Frayer/Getty Images Reuters reported that China told state-owned banks to get ready to sell dollars and buy yuan in an effort to prop up the local currency. The move could stem the yuan’s fall, as it remains on track for its largest annual loss against the dollar since 1994. A hawkish Fed has pushed the dollar to 20-year highs this year, pressuring currencies around the world. The People’s Bank of China has told major state-run banks to prepare to shed dollar… Source link

Read More »Central banks around the globe are keeping Wall Street up at night: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, September 29, 2022 Today’s newsletter is by Jared Blikre, a reporter focused on the markets on Yahoo Finance. Follow him on Twitter @SPYJared. The Dow Jones Industrial Average (^DJI) rallied Wednesday — putting in its best showing in two months — on the back of a massive, risk-on reversal in global bond and currency markets. The U.S…. Source link

Read More »Where Wall Street’s mega banks stand on return-to-office policies

Late hours on Wall Street are part of industry lore, but in a post-pandemic world, banks are still hashing out official return-to-office policies. Earlier this week, moves by Goldman Sachs and Morgan Stanley to lift COVID protocols at their offices drew attention to the ambiguity around official RTO rules across financial institutions. While messaging from the companies was shy of mandating a five-day-per-week return, lifting vaccine and testing requirements appears to be part of a broader… Source link

Read More »Elon Musk’s decision to pull a $44 billion deal for Twitter could see Wall Street’s top banks lose hundreds of millions of dollars, scuppering one of 2022’s biggest pay days.

Britta Pedersen/Getty Images; Twitter; Rachel Mendelson/Insider Elon Musk’s decision to kill the $44 billion Twitter deal means banks could lose a “nine-figure” payday. Musk’s and Twitter’s financial advisors could pocket up to $192 million if the deal closes. The billionaire faces an uphill battle to call off the deal as he has to prove there’s been a material adverse effect on the transaction. Elon Musk’s ‘will-he-won’t-he’ dance to buy Twitter took a turn on Friday after the billionaire said… Source link

Read More »Warren Buffett broke up with most of his beloved banks — so why is he swooning over this one?

Warren Buffett broke up with most of his beloved banks — so why is he swooning over this one? The Oracle of Omaha has had a busy quarter. According to his latest 13F filing, Warren Buffett has deployed roughly one-third of his cash into new investments during the first three months of the year. As always, Buffett’s biggest swings are noteworthy. However, his decision to sell most bank stocks while adding Citigroup (C) to Berkshire Hathaway’s (BRK) portfolio is puzzling Wall… Source link

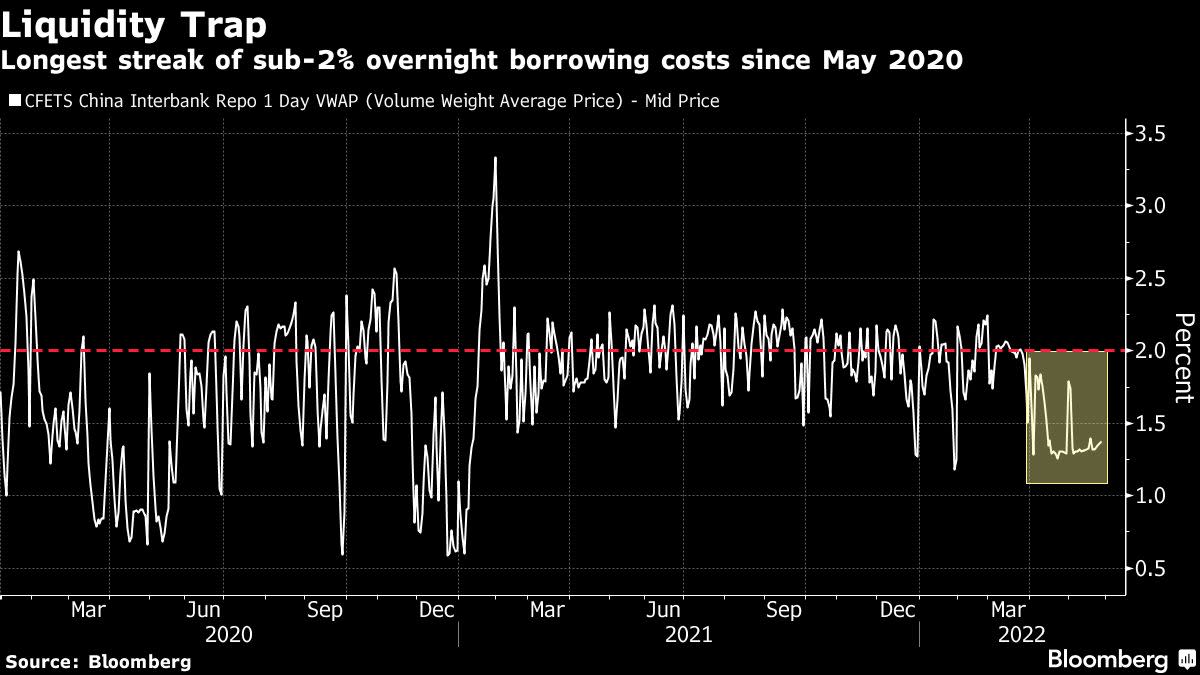

Read More »Chinese Banks Overflow With Cash That Nobody Wants to Borrow

(Bloomberg) — Chinese authorities are facing an uphill battle convincing companies and households to boost borrowing as long as Covid outbreaks and lockdowns continue to crush confidence. Most Read from Bloomberg After loan growth weakened in April to the worst level in almost five years, several indicators suggest the data for May won’t be much better. Housing sales have continued to slump, indicating a lack of appetite for mortgages and subdued credit demand among developers and sectors… Source link

Read More »