[unable to retrieve full-text content]Stock market news today: Futures mixed as Salesforce lifts Dow, Treasury slide continues Yahoo Finance Source link

Read More »U.S. to announce oil price cap in coming days, Treasury official says

The U.S. on Tuesday released detailed guidelines on how to legally participate in trading or financing Russian oil, days away from announcing an official price cap, according to a senior Treasury official who previewed the guidelines. The U.S. has joined forces with the G-7, European Union, and Australia to ban imports on Russian oil, part of sanctions the U.S. and other nations have rolled out since Russia’s invasion of Ukraine. The countries have also agreed to fashion a price cap on… Source link

Read More »Stock futures fall, Treasury yields rise as Wall Street weighs jobs data

U.S. stocks tumbled early Friday as the government’s key employment reading showed the labor market grew at a slower pace in September. The U.S. economy added 263,000 jobs last month as the unemployment rate fell to 3.5%. Economists expected a payroll gain of 255,000 and for unemployment to hold at 3.7%. Futures tied to the S&P 500 (^GSPC) dropped 0.7%, while futures on the Dow Jones Industrial Average (^DJI) shed more than 100 points, or 0.4%. Nasdaq Composite (^IXIC) futures led the way… Source link

Read More »Stocks open mixed after 10-year Treasury briefly hits 4%

U.S. stocks struggled for direction early Wednesday after the 10-year Treasury yield – a key economic linchpin – briefly spiked past 4%, hitting a closely watched level for the worst bond sell-off in decades. The S&P 500 was up a modest 0.1%, while the Dow Jones Industrial Average added 60 points, or around 0.2%. The Nasdaq Composite was off by 0.2%. Across the Atlantic, the Bank of England said it would carry out temporary purchases of long-dated U.K. government bonds, an emergency… Source link

Read More »Huge sell-off rocks Treasury markets, yield curve inverts

By Yoruk Bahceli and Sujata Rao (Reuters) -U.S. two-year Treasury yields rose above 10-year borrowing costs on Monday – the so-called curve inversion that often heralds economic recession – on expectations interest rates may rise faster and further than anticipated. Fears the U.S. Federal Reserve could opt for an even larger rate hike than anticipated this week to contain inflation sent two-year yields to their highest levels since 2007. But a view is also playing out that aggressive rate hikes… Source link

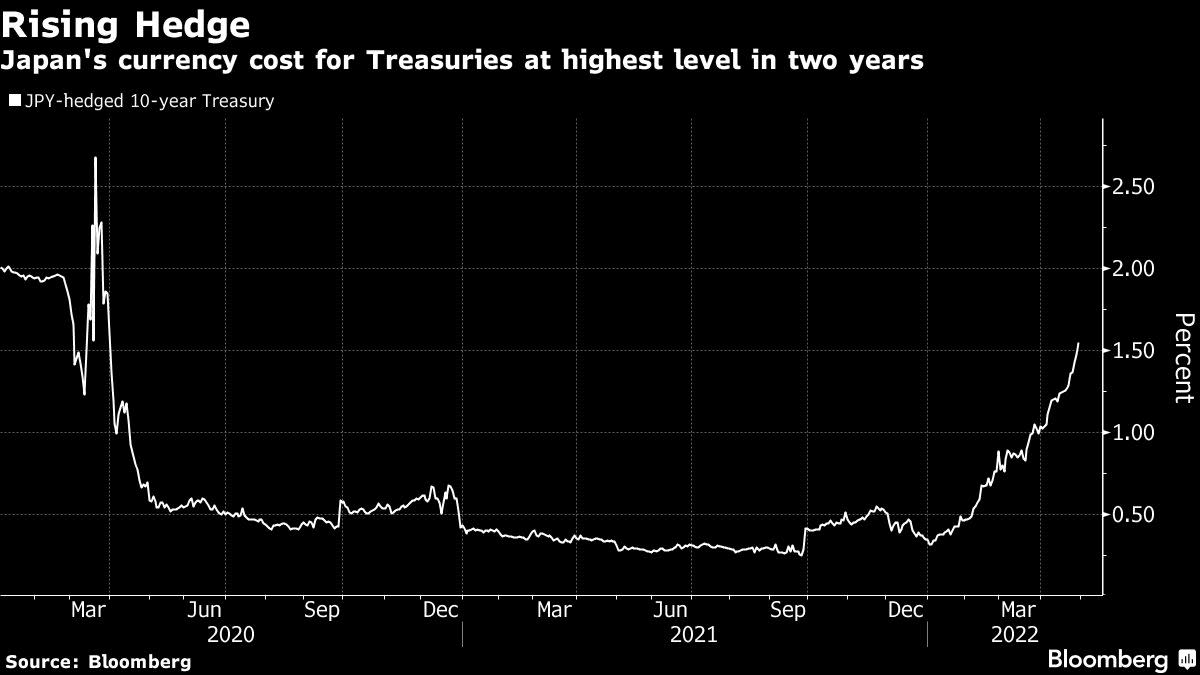

Read More »Biggest Treasury Buyer Outside U.S. Quietly Offloads Billions

(Bloomberg) — In times of Treasury turmoil, the biggest investor outside American soil has historically lent a helping hand. Not this time round. Most Read from Bloomberg Japanese institutional managers — known for their legendary U.S. debt buying sprees in recent decades — are now fueling the great bond selloff just as the Federal Reserve pares its $9 trillion balance sheet. The latest data from BMO Capital Markets show the largest overseas holder of Treasuries has offloaded almost $60… Source link

Read More »Stock futures drop, Treasury yields spike as traders await inflation, earnings data

U.S. stock futures pointed to a lower open Monday morning as investors looked ahead to the start of corporate earnings season this week and a bevy of new economic data as the Federal Reserve prepares to accelerate its moves to counter inflation. Contracts on the S&P 500 declined and added to last week’s losses. Nasdaq futures dropped as technology stocks came under renewed pressure. Treasury yields climbed, and the benchmark 10-year yield rose above 2.7% to reach the highest level since… Source link

Read More »Crypto should be regulated by CFTC, not SEC, Treasury: Ex-official

The Commodity Futures Trading Commission, rather than the Securities and Exchanges Commission or the U.S. Treasury, should supervise cryptocurrency markets, its former chairman told Yahoo Finance in an interview on Friday. As the debate over digital token oversight takes shape and the White House prepares an overarching strategy, J. Christopher Giancarlo said it’s time for Congress to take the lead and permit his former agency to run point on the asset class’ regulation. An inter-agency… Source link

Read More »Stablecoins need ‘clear, consistent’ rules as crypto booms: Treasury official

A top Treasury official on Tuesday is expected to make the case to Congress that there are gaps in the framework for stablecoins, should they become widely used by households and businesses. As lawmakers and the White House weigh oversight of the booming cryptocurrency sector, regulators and policymakers need to monitor stablecoins closely, according to Nellie Liang, Undersecretary for Domestic Finance. Liang is testifying before the House Financial Services Committee as the sole witness on… Source link

Read More »Stocks, Futures Fall as Treasury Yields Surge: Markets Wrap

(Bloomberg) — Most stocks fell Tuesday amid a jump in global bond yields as investors girded for the removal of central bank support to quell high inflation. Most Read from Bloomberg Europe’s Stoxx 600 Index declined, with energy the only sector to advance. U.S. equity futures slipped before the market reopens later from a holiday. Asian shares struggled. Treasuries dropped across the curve, pushing two-year and 10-year yields up to levels last seen before the pandemic roiled markets. Even… Source link

Read More »