[unable to retrieve full-text content]Treasuries Hit as Hawkish Fed Views Keep Piling Up: Markets Wrap Yahoo Finance Source link

Read More »Stocks Churn in Choppy Session, Treasuries Steady: Markets Wrap

(Bloomberg) — US stocks swung between gains and losses as markets digested upbeat corporate news and data on producer prices that will keep pressure on the Federal Reserve to tighten policy. Treasuries held steady, while UK markets were roiled once again by policy concerns. Most Read from Bloomberg The S&P 500 fluctuated as the benchmark attempted to stage a comeback after a five-day losing streak. Consumer staples and health care topped the leaderboard with gains in PepsiCo Inc. and Moderna… Source link

Read More »Treasuries Sell Off, Asia Stocks Drop; Oil Jumps: Markets Wrap

(Bloomberg) — Stocks in Asia fell Tuesday and Treasuries sold off across the curve as investors remain cautious about whether central banks can raise interest rates to rein in inflation without derailing growth. Oil gained after the European Union backed a push to ban some Russian oil. Most Read from Bloomberg Equities in Japan, Korea and Australia inched down while Hong Kong futures fell. US contracts opened higher in the first day of trading after the Memorial Day weekend. Yields on… Source link

Read More »Treasuries Slump Ignites Global Selloff as Rate Hikes Gain Focus

(Bloomberg) — U.S. Treasury yields’ advance to a three-year high kicked off a global jump in borrowing costs as traders refocused on intensifying bets on rate hikes from major central banks. Most Read from Bloomberg Ten-year U.S. yields climbed through 2.75% for the first time since March 2019 as investors priced in the impact of the Federal Reserve’s tightening plan and accelerating inflation. Traders are betting on nine quarter-point Fed rate hikes by year-end, which — including last… Source link

Read More »Stocks, Treasuries Sink on Inflation, Policy Risks: Markets Wrap

(Bloomberg) — Stocks and U.S. equity futures fell along with Treasuries Monday amid heightened worries about inflation risks and tightening financial conditions. A gauge of the dollar climbed. Most Read from Bloomberg An Asia-Pacific equity index shed more than 1%, dropping to the lowest since mid-March. China and Hong Kong struggled, with tech shares skidding on new guidelines from Beijing aimed at curbing data monopolies at internet platforms. U.S. and European futures also declined,… Source link

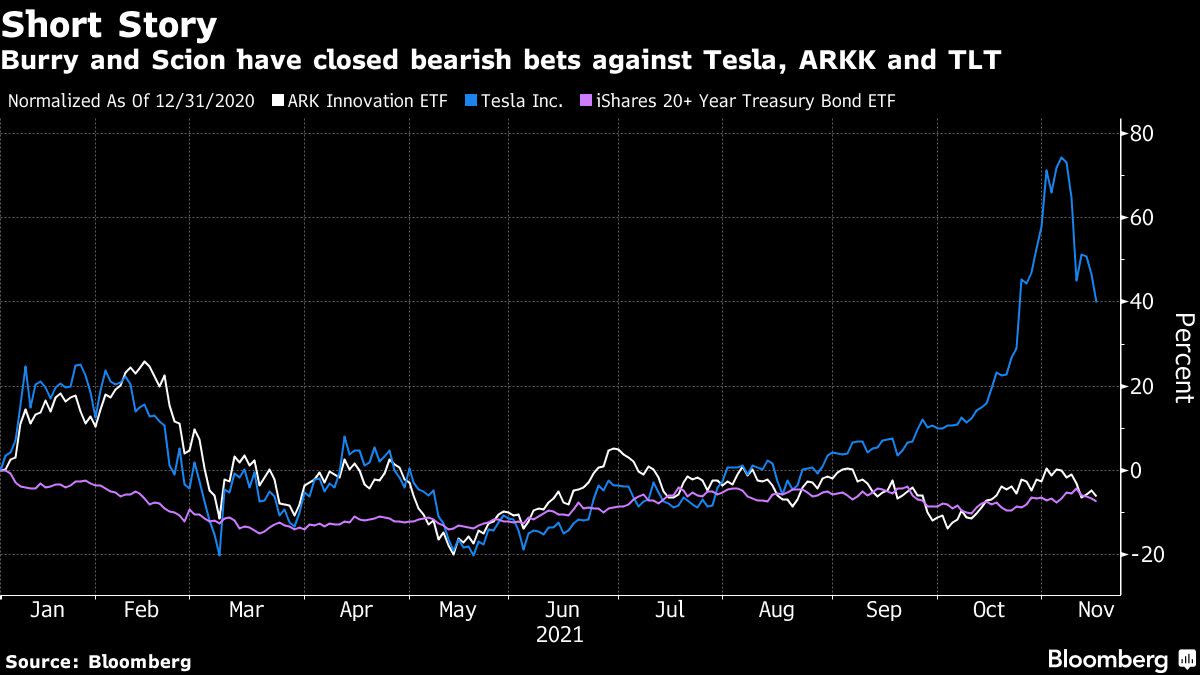

Read More »Big Short’s Michael Burry Closes Bets Against Ark, Tesla and Treasuries

(Bloomberg) — Michael Burry may have ditched some of his biggest shorts — at least for now. Most Read from Bloomberg Scion Asset Management, which Burry founded and runs as chief executive officer, had cut back to only a handful of positions as of the end of September, according to a regulatory filing made on Monday. Among trades that the firm closed in the third quarter were bets against Cathie Wood’s flagship ARK Innovation ETF, Elon Musk’s Tesla Inc. and the biggest Treasuries… Source link

Read More »Stocks Climb as Japan, China Gain; Treasuries Dip: Markets Wrap

(Bloomberg) — Most Asian stocks rose Tuesday as Japan extended a rally and traders took heart from indications that the global recovery is weathering challenges from the delta virus variant. Japan’s Nikkei 225 hit 30,000 for the first time since April as an index reshuffle added to optimism that a new prime minister will usher in favorable policies. China climbed, aided by a continuing rebound in technology stocks and better than expected trade data. S&P 500 and Nasdaq 100 futures edged up… Source link

Read More »Michael Burry’s Pretty Big Short Hinges on Treasuries Sinking

(Bloomberg) — Call it the Pretty Big Short. Michael Burry, whose huge, wildly profitable bets against the housing bubble were made famous in “The Big Short,” is wagering that long-term U.S. Treasuries will fall. His Scion Asset Management held $280 million of puts on the iShares 20+ Year Treasury Bond ETF at the end of June, according to a regulatory filing released this week, an increase from $172 million three months earlier. The options contracts would make money if TLT, as the… Source link

Read More »Stocks Drop, Treasuries Climb Amid Growth Caution: Markets Wrap

(Bloomberg) — Asian stocks and U.S. futures fell Monday on concerns about the impact of Covid-19 outbreaks and elevated inflation on economic prospects. Treasuries climbed and oil slipped after an OPEC+ supply deal. Shares fell across the region, with Japan and Hong Kong underperforming. China opened with more modest losses. S&P 500 and Nasdaq 100 futures dropped after the S&P 500 fell for the first week in four. The rally in Treasuries continued, sending 10-year yields further below… Source link

Read More »Asian Stocks Rise; Treasuries Steady After Slide: Markets Wrap

(Bloomberg) — Asian stocks started the week higher after their U.S. peers chalked fresh records and Treasury yields stabilized after jumping Friday. Shares in Japan outperformed and Hong Kong opened higher. China rose after the central bank cut the amount of cash most banks must hold in reserve to buttress a slowing economic expansion. Australia saw a more modest advance amid a prolonged lockdown in the largest city, Sydney. U.S. contracts fluctuated. The S&P 500 finished last week at… Source link

Read More »