(Bloomberg) — Stocks came under pressure as a trio of tech heavyweights fell, with traders wading through mixed economic data in the run-up to Jerome Powell’s testimony to Congress. Most Read from Bloomberg Equities lost traction after a rally that has spurred concern about sky-high valuations — especially in megacaps, leaving the group vulnerable to big moves in the face of bad news. Apple Inc.’s iPhone woes in China deepened while Advanced Micro Devices Inc. hit a US roadblock in… Source link

Read More »Complying with the Digital Markets Act

The European Union’s Digital Markets Act (DMA) comes into force this week for companies who have been designated. Today, we are sharing some more details about the changes we are making to comply, following product testing we announced earlier this year. The changes that we have made are the result of intensive work over many months from engineers, researchers, product managers and product designers from across the company. Throughout this process, we have engaged extensively with the… Source link

Read More »Stock Rally Stalls at Start of Data-Packed Week: Markets Wrap

(Bloomberg) — The stock market lost steam near record highs as traders braced for a barrage of economic data and remarks from Federal Reserve speakers that will help shape the outlook for interest rates. Most Read from Bloomberg Wall Street is also keeping a close eye on how the market absorbs heavy Treasury and corporate sales amid month-end positioning. US yields rose after Monday’s auctions of two-year and five-year government notes. Meantime, blue-chip companies are expected to sell… Source link

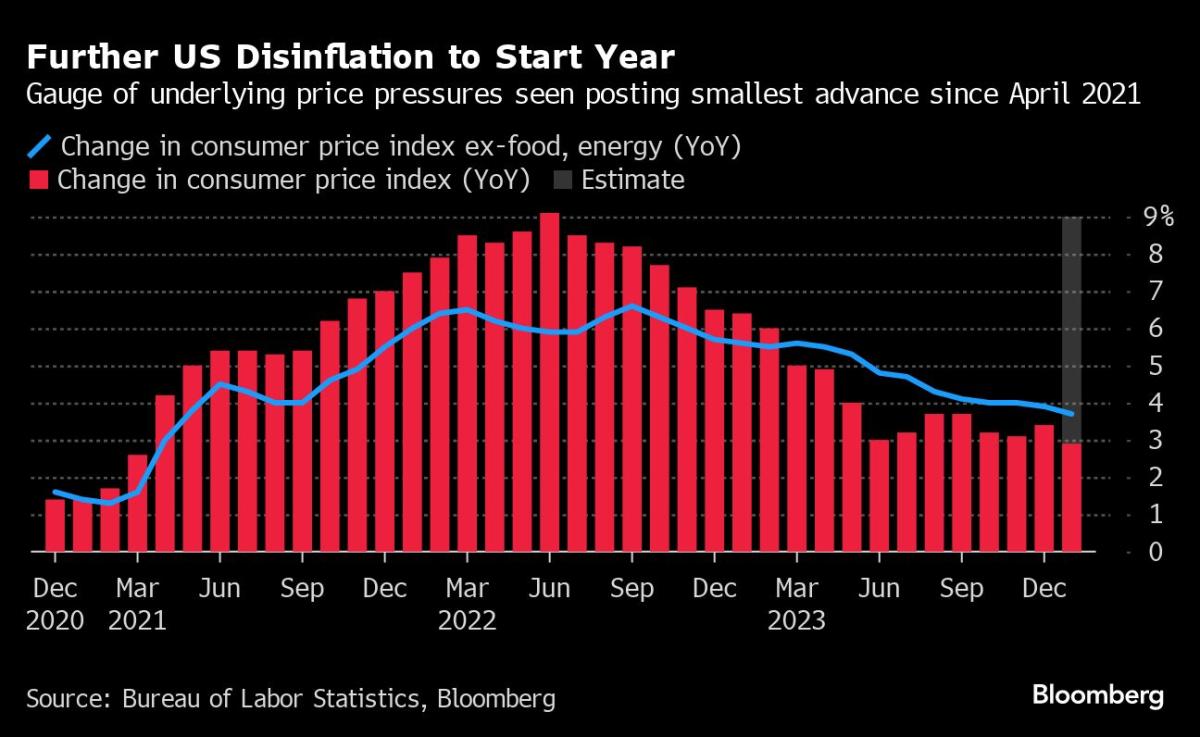

Read More »Wall Street Caught Off Guard by ‘Sticky’ CPI Signs: Markets Wrap

(Bloomberg) — Wall Street got a reality check on Tuesday, with hotter-than-estimated inflation data triggering a slide in both stocks and bonds. Most Read from Bloomberg Equities pushed away from their all-time highs as the consumer price index topped estimates across the board. Treasuries sold off, with two-year yields hitting the highest since before the Fed’s December “pivot.” Swap traders ratcheted down their expectations for a central bank cut before July. The stock market’s… Source link

Read More »European Stocks Push Higher on Coattails of S&P: Markets Wrap

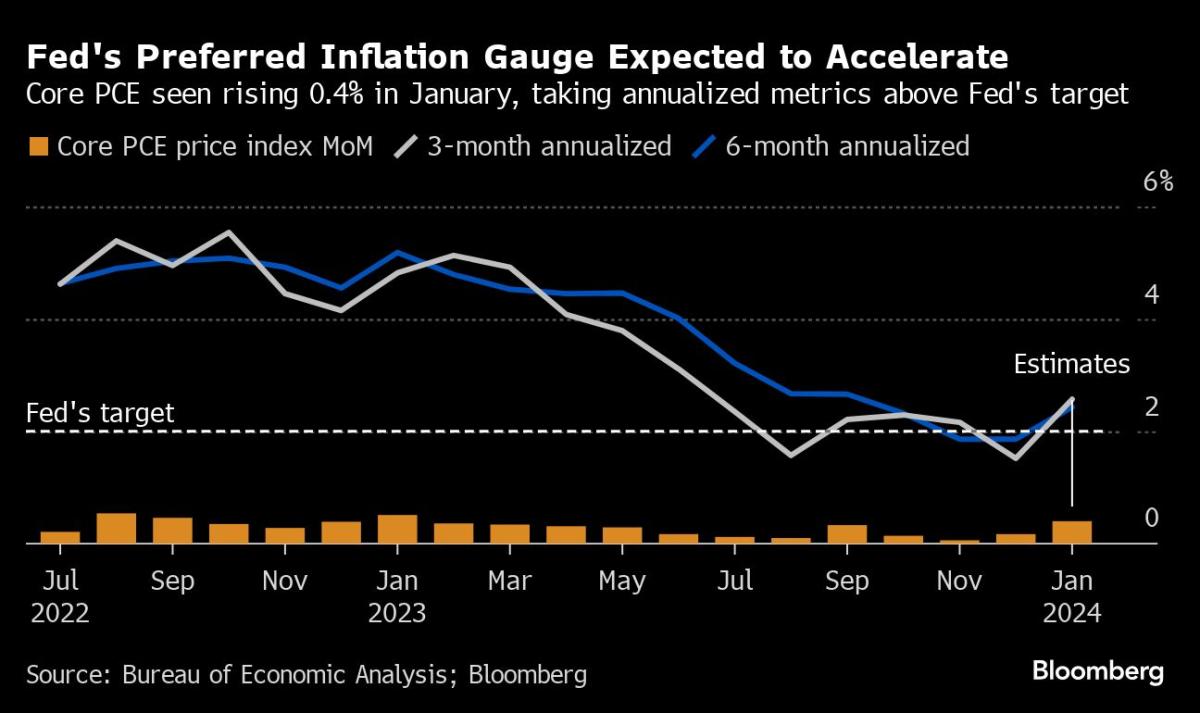

(Bloomberg) — European stocks edged up after the S&P 500 closed at a new record high Friday amid optimism over eventual Federal Reserve interest-rate cuts and as investors look forward to a crucial update on US inflation. Most Read from Bloomberg Rates-sensitive real estate stocks led broad gains across almost every industry group in Europe. Shares in Italian luxury brand Tod SpA shares rose as much as 18% after the founding family said it had enlisted buyout firm L Catterton in a new attempt… Source link

Read More »US Futures Fluctuate With S&P 500 on Cusp of 5,000: Markets Wrap

(Bloomberg) — Stocks and bonds fluctuated on Thursday as investors grappled with a slew of company reports and prepared for a sale of 30-year US government debt. Most Read from Bloomberg US equity futures edged lower. The Stoxx 600 traded flat on the busiest day of the European earnings season. Arm Holdings Plc jumped 25% in premarket trading after a bullish forecast from the chip designer. A.P. Moller-Maersk A/S tumbled after predicting a slowdown in the shipping industry. Markets have so far… Source link

Read More »S&P 500 Closes on the Brink of Historic 5,000 Mark: Markets Wrap

(Bloomberg) — The historic rally in US stocks continued to power ahead, with the S&P 500 closing within a striking distance of 5,000. Most Read from Bloomberg Gains on Wednesday were fueled by a renewed surge in big tech and a strong sale of 10-year Treasuries that dimmed supply concerns. While bonds barely budged, equities extended their bull run on prospects that a solid economy will continue fueling corporate profits. In late trading, Walt Disney Co. and Arm Holdings Plc jumped on upbeat… Source link

Read More »Stock Bull Run Powers Ahead as US Economy Roars: Markets Wrap

(Bloomberg) — The stock market extended this week’s gains as big tech rallied and a solid jobs report bolstered the outlook for corporate profits. Most Read from Bloomberg Equities hit all-time highs, with the S&P 500 approaching 5,000 and the Nasdaq 100 up 1.7% on bullish outlooks from Meta Platforms Inc. and Amazon.com Inc. Economic optimism outweighed bets the Federal Reserve will be in no rush to cut rates. Treasury two-year yields jumped 16 basis points to 4.36%. The dollar climbed to… Source link

Read More »Big Tech Gets Crushed, Bonds Gain in Run-Up to Fed: Markets Wrap

(Bloomberg) — Wall Street traders gearing up for the Federal Reserve decision scrambled to digest a selloff in big tech, the Treasury refunding plans and weaker-than-forecast data. Fresh concerns about regional lenders added to economic concerns that sent bond yields plunging, though banks pared losses as the session progressed. Most Read from Bloomberg The most-influential group in the S&P 500 got hammered on Wednesday after some of its biggest names failed to live up to high expectations… Source link

Read More »31 charts tell the story of markets and the economy to start 2024

Stocks have surged to record highs at the start of 2024. Inflation has moderated, the Federal Reserve looks set to cut interest rates, and the vaunted “soft landing” for the US economy is coming into view. The US economy and corporate America continue to prove resilient in the face of the Federal Reserve’s aggressive rate hikes. This optimism reflected in recent market action and the economic consensus serves as the central theme of the latest Yahoo Finance Chartbook, which brings together more… Source link

Read More »