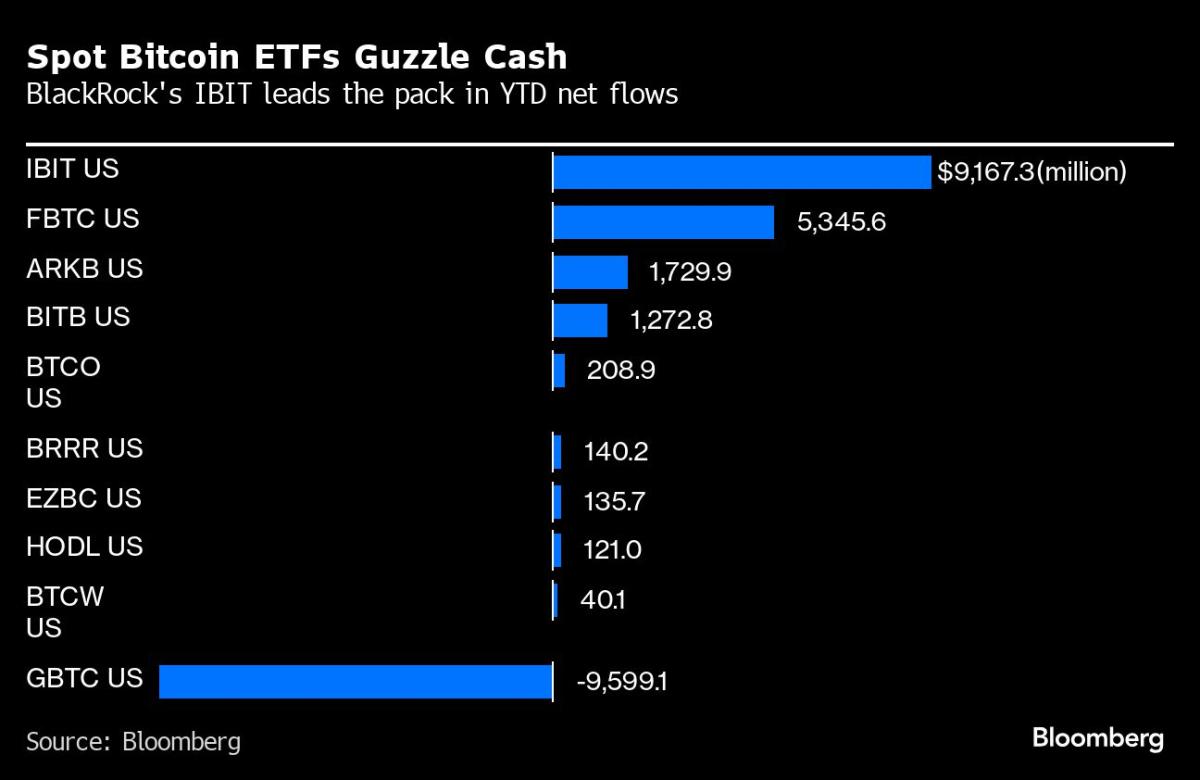

(Bloomberg) — Investors dumped a record amount of cash into BlackRock’s Bitcoin ETF while the cryptocurrency surged to an all-time high. Most Read from Bloomberg The iShares Bitcoin ETF (ticker IBIT) pulled $788.3 million Tuesday, its 37th consecutive inflow. The fund has now swelled to $11.5 billion in assets. Bitcoin briefly topped $69,000 on Tuesday, surpassing the all-time high it hit in late 2021. Demand from the ETFs and a optimism surrounding an upcoming reduction in the token’s… Source link

Read More »