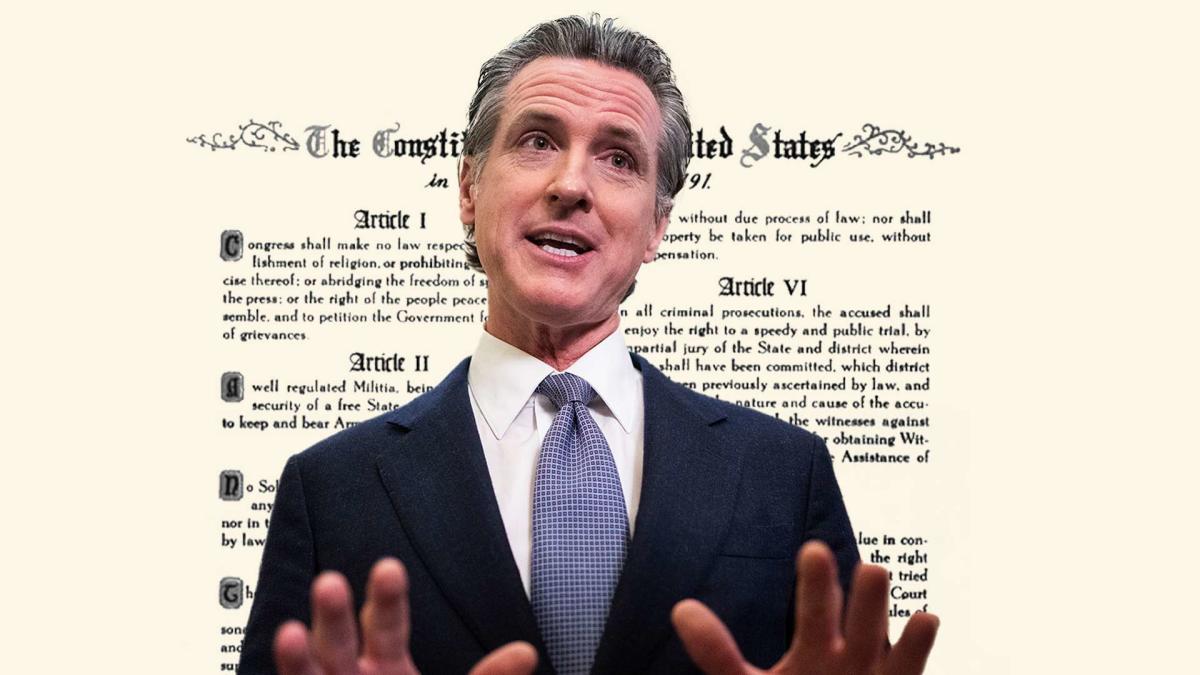

California Gov. Gavin Newsom thinks the Constitution should be amended to accommodate the gun regulations he favors. But in the meantime, he is trying out a different strategy: If we ignore the Second Amendment, maybe it will go away. In 2022, the U.S. Supreme Court upheld the right to carry guns in public for self-defense, saying states could not require residents to demonstrate a “special need” before allowing them to exercise that right. Newsom responded to what he called a “very bad… Source link

Read More »