The Rolling Stones reflect on aging, and Charlie Watts. (Photo: REUTERS/Mario Anzuoni) Ahead of their upcoming 14-date tour — which marks 60 years since the Rolling Stones formed — Mick Jagger, Keith Richards and Ronnie Wood are sharing how they stay spry in their 70s. Both Jagger and Richards are 78, while Wood will celebrate his 75th birthday on June 1. In a new interview with the Sunday Times, Jagger acknowledges that the band’s exhaustive touring schedule defies expectations about… Source link

Read More »What to know this week

The global business elite will gather in the mountains of Davos, Switzerland this week amid a backdrop of turbulent markets and an uncertain economic outlook. For the first time in over two years, CEOs, politicians, and billionaires are set to congregate at the World Economic Forum following a pandemic-induced hiatus. Russia’s war in Ukraine, the COVID-19 pandemic, and worries of economic gloom will be among the key topics discussed, as the world’s top leaders face the most uncertain… Source link

Read More »Which beaten down stocks should I buy for the juiciest upside? Here are 3 high-growth tech ideas hitting fresh 52-week lows

Which beaten down stocks should I buy for the juiciest upside? Here are 3 high-growth tech ideas hitting fresh 52-week lows “Be fearful when others are greedy and greedy when others are fearful.” Of all of investing legend Warren Buffett’s memorable quotes, that’s probably his most famous. But it’s a lot easier said than done. When stocks are soaring, everyone wants a piece of the action. Meanwhile, the down-and-out stocks rarely get a second look. After the market rebounded from the… Source link

Read More »A major shift in the economic narrative could be underway

The overarching narrative of the markets and economy has been one of strong demand meeting lagging supply, a dynamic that has caused inflation to surge. While most signs suggest these trends continue to persist, a handful of anecdotes from the past week suggest this narrative could be changing. Signs that inventories are no longer depleted Supply chain disruptions have been reflected by depressed inventory/sales ratios. In fact, many businesses have been complaining that sales would be stronger… Source link

Read More »Suze Orman says you can avoid 5 common mistakes people make in a stock market crisis

Suze Orman says you can avoid 5 common mistakes people make in a stock market crisis Alarm bells are ringing out on the stock market, and personal finance expert Suze Orman has heard them along with you and has advice as you warily watch your investments lose value. The Women & Money podcast host fears people will make dire mistakes out of panic in a shaky market, with predictions of a recession. “I know that your tendencies right here and right now are to start selling everything,” Orman… Source link

Read More »Why so many Americans are struggling with their mental health: Headspace CEO

It’s no secret that the last few years have had a devastating effect on Americans’ mental health. The coronavirus pandemic was the trigger, but it’s not the only factor at play. Stock market volatility has affected finances, millions of Americans lost their jobs over the past two years, and global conflict like the Russia-Ukraine war has only added to the pressure. It’s why Headspace Health CEO Russell Glass is encouraging everyone to consider meditation. “We think about meditation… Source link

Read More »Index funds officially overtake active managers

Allan Sloan is a seven-time winner of the Loeb Award, business journalism’s highest honor. There are times when simple numbers tell a big story for investors — and this is one of them. Today’s numbers involve index funds: Mutual funds that seek to replicate market indicators like the Standard & Poor’s 500 Index or the Nasdaq market or the total U.S. stock market rather than try to outperform them. For the first time in history, retail investors’ index fund holdings exceed their… Source link

Read More »Stock Market Is Near Capitulation As Market Rotation Out From This Sector

Many traders and investors speculated about a potential market bottom or at least a meaningful rally could be around the corner as S&P 500 rallied from the oversold condition below 3900 to almost 4100 just within 4 days. The rally was expected to be short-lived as explained in the video at the bottom of the post using multiple scenarios focusing on the characteristics of the price action in order to differentiate a bull trap from a market bottom. This was further supported by the bearish… Source link

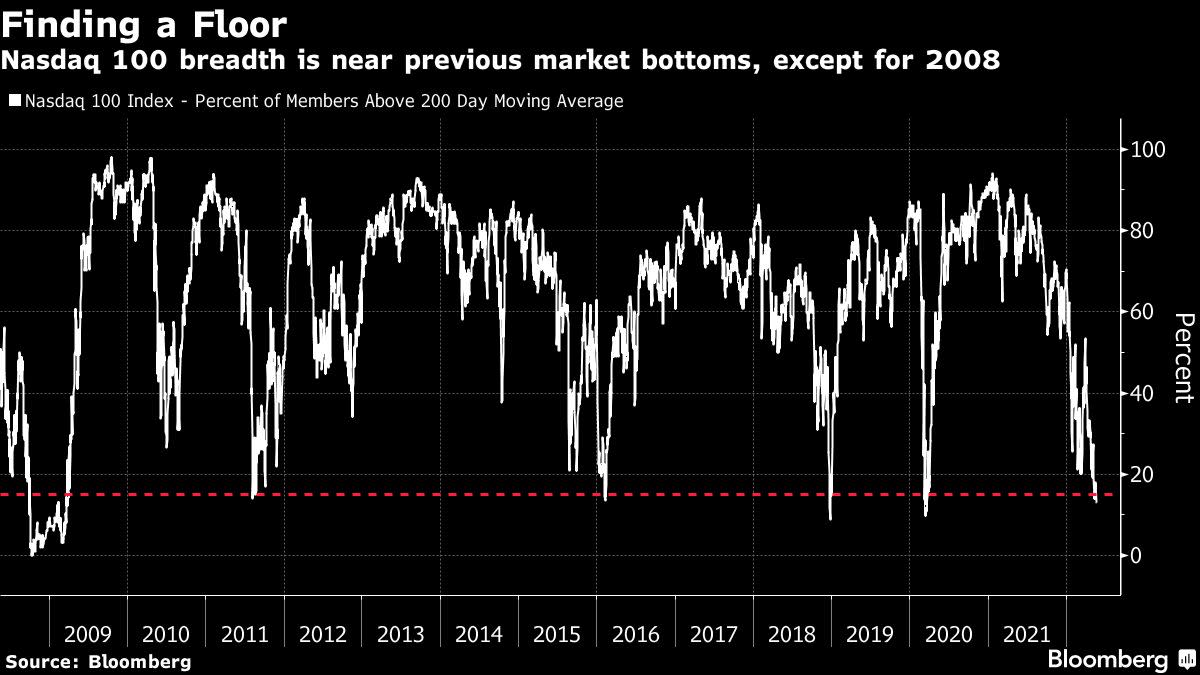

Read More »After Meltdown, Tech-Bottom Signals Have Yet to Scream ‘Buy Now’

(Bloomberg) — Calling the bottom in the tech-sector meltdown isn’t easy, even after a $5.5 trillion wipe-out, yet there are some signals giving investors hope. Most Read from Bloomberg Tech stocks have been hammered this year as rising interest rates, slowing economic growth and soaring inflation form a perfect storm of negative catalysts. That’s hurt everyone from retail investors who loaded up on Cathie Wood’s Ark Investment exchange-traded funds last year to deep-pocketed asset… Source link

Read More »Heat fight back Celtics rally to take 2-1 ECF lead

What initially looked like a Heat romp on Saturday turned into a sweat for Miami with its best player sidelined. But when the game was done, the Heat emerged with a hard-fought 109-103 win over the Boston Celtics to secure a 2-1 series lead in the Eastern Conference finals. They did so late without Jimmy Butler, who missed the entire second half with knee inflammation. After totaling 16 points in Games 1 and 2, Bam Adebayo powered the Heat to victory with his best game of the series. Bam… Source link

Read More »